What’s on this page:

Introduction

As a property manager, there are several ways to increase the revenue that is generated from your listings. If you want to increase demand, you can do more marketing. If you want to increase the potential number of people that see your property, you can increase your distribution. If you want to find the best price to match supply and demand, you can do revenue management.

Revenue management is a great tool and process to use because it should increase your revenue much more than it increases your cost. As a property manager, that is a great proposition. The technical cost of updating the rates is pretty low when using software. It is basically just the cost of sending new rates to the PMS through an API. What you are paying for when you invest in revenue management is the model that makes the pricing decision and the person managing that process. This is where the numbers get crunched and the work gets done.

So, when you are selecting a revenue management system, it is critical to know what the underlying pricing model is that sets the rates. All pricing models are not the same and the better pricing model you chose the less manual changes will be needed from your revenue manager and the more revenue will be generated.

“All pricing models are not the same and the better pricing model you chose the less manual changes will be needed.”

Types of Models

There are two basic types of pricing models. The first are rules based models. These types of models can be described using if/then statements. Imagine creating a pricing calculation in an Excel document and creating an If statement that says: If the average market price decreases on day X, then decrease my price by the same amount. Similarly it could say, if no bookings come in in the next 5 days then drop my price by 5%. Rules based models generally try to replicate what you would do, but with much greater scale.

“Rules based models generally try to replicate what you would do, but with much greater scale.”

Next are price optimization models. These types of models do more complicated calculations to solve for a price that is theoretically optimal. Another categorization of these models is probability based models, because they make predictions about future states of the market. These models are normally broken down into two steps. First, the forecast step and second the optimization step.

“Another categorization of these models is probability based models, because they make predictions about future states of the market.”

Rules Based Model

These models have been on the market for the longest time and what property managers are most familiar with. The basic premise of this model is that the user decides what an average price will be for the property and uses that as the “base price.” The model will move that base price up or down based on the price of the competitors in the area.

Additional rules can be added to further modify the price. Many managers add discounting schedules to their pricing strategy that force price discounts as time starts to expire for the inventory. Similarly, minimum stay strategies are controlled with rules and configured to update as time approaches the spoil date of the inventory.

Optimization Models

This type of model has just recently made it to the STR industry, so they are less familiar to property management companies. Instead of a rules based system, these models solve for the best price. The process of solving for the price that maximizes revenue is called optimization and that is where the distinction comes. Optimization models are what airlines and more advanced hotel operators use.

“The process of solving for the price that maximizes revenue is called optimization and that is where the distinction comes.”

Gains from each model

The reason for using a pricing model and varying prices is to try to capture more revenue from the market. By better matching supply and demand, property managers can increase the total revenue of the property. So choosing the right pricing model is critical.

“So choosing the right pricing model is critical. “

The revenue gains from varied pricing can come before even choosing a pricing model. Price variation can be done manually inside the PMS. There are some reliable adjustments that can be made to pricing that will likely make improvements in your total revenue. By determining seasonality and demand by day of the week, you can make a big move toward increasing RevPAR.

But, there will come a time when you want to make some pricing tweaks because bookings are not what you expected. Doing this directly in the PMS can be a bit challenging and time consuming especially if you are managing a large amount of properties. There are also constant pricing changes going on in the market that you might want to follow and stay competitive with. That is where a base price model can help. It will automate many price changes that you may have previously made manually. You can improve your revenue using a base price model because it can make a lot more changes in an automated way than doing it manually.

For further gains, the next step up the chain is the price optimization model. These models are solving for the price, so they need to ingest a lot more information. But, that information helps the model make more nuanced pricing decisions. This adds complexity to the pricing decision, but it also adds accuracy to the final price. The benefits of running optimization models is well established in hotel and airline research and eliminates the users need to set base prices.

Why they are limited

When choosing a pricing model it is important to understand the limitations and advantages of each option. No pricing model is perfect or will ever be perfect. To set the exact right price for anything the model would need access to things that don’t even exist yet. At the end of the day the behavior that we are trying to predict is what a human is going to do in the future, which is extremely difficult. Most people can’t even predict their own future behavior that well so it is hard to imagine a model doing a better job.

“No pricing model is perfect or will ever be perfect. “

So the limitations of each of these models is based on the underlying technology. If you are pricing manually, without using any software at all, the person setting the rates is the underlying technology and is limited largely by time. It can take a lot of time to update rates especially as your portfolio grows. Using a base price model has a limit of what it can produce based on how it is setting the rates. The human is setting the base rate which is used as the foundation for all future dates. This lacks specificity that an Optimization model is able to overcome. But, the optimization model still has limitations depending on what data it can ingest and how well it gets tuned.

What model is right for your business?

This is not necessarily a formula to use to decide which pricing model is best for your business. In terms of highest revenue potential, using the science of optimization will deliver the highest revenue. But, if you are already using a base price model does it make sense to switch? There is also a cost to running any of these models, whether it be time or money or both.

“In terms of highest revenue potential, using the science of optimization will deliver the highest revenue. “

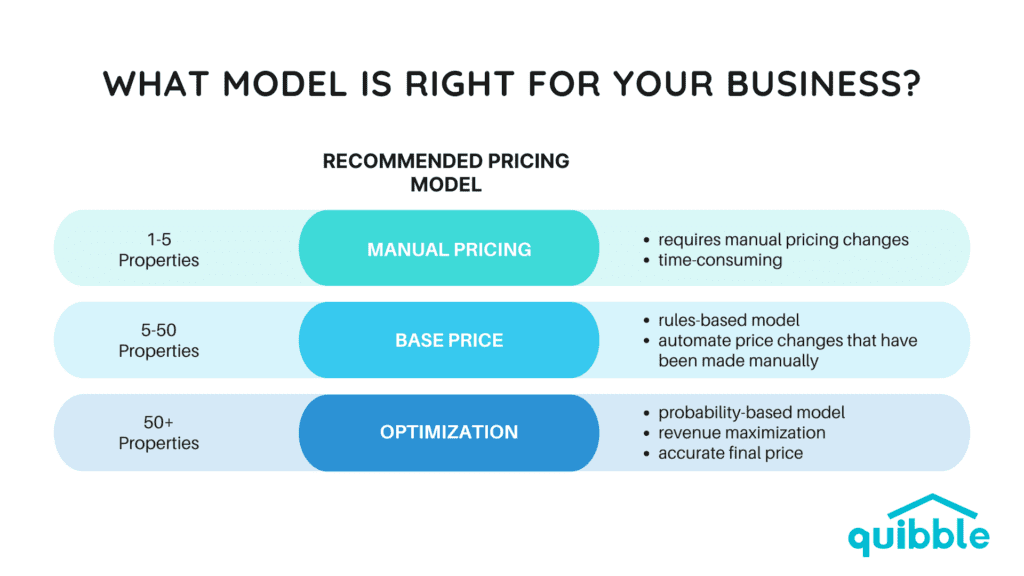

Based on what we have seen in the market this is a guide by portfolio size of which model makes most sense:

There are many exceptions to this guide. The more properties you need to manage the more automation helps. As you move into the 50+ range, the benefits of science based optimization really becomes a necessity.

“The more properties you need to manage the more automation helps.”

If you want to learn more about science based pricing, get in touch with us.

Join our newsletter

Dominate the short-term rental market with cutting-edge trends