Congratulations on taking the initiative to set a budget for 2023! Establishing a budget can be overwhelming, but it’s essential to achieving your financial goals. This will allow you to plan ahead and ensure you are prepared financially for the upcoming year. In addition, having a budget in place will allow you to make better decisions when it comes to spending and saving, ensuring that you can operate your business with confidence and make the most of your money. Here are some tips to help you create a budget that works for you:

🏗 Setting your budget now will help you better understand your financial situation and plan for the upcoming year.

Start by tracking your spending for a few months. It can be intimidating initially, but it doesn’t have to be. Start by writing down your income and expenses to see how much money you have coming in and how much is going out. This will give you an idea of your current spending habits and financial situation. You can then set realistic goals for yourself and create a budget that works for you for the upcoming year. With a plan in place, you can better manage your finances and understand your financial situation.

“With a plan in place, you can better manage your finances and understand your financial situation.”

✅ It will allow you to track your progress and adjust as needed.

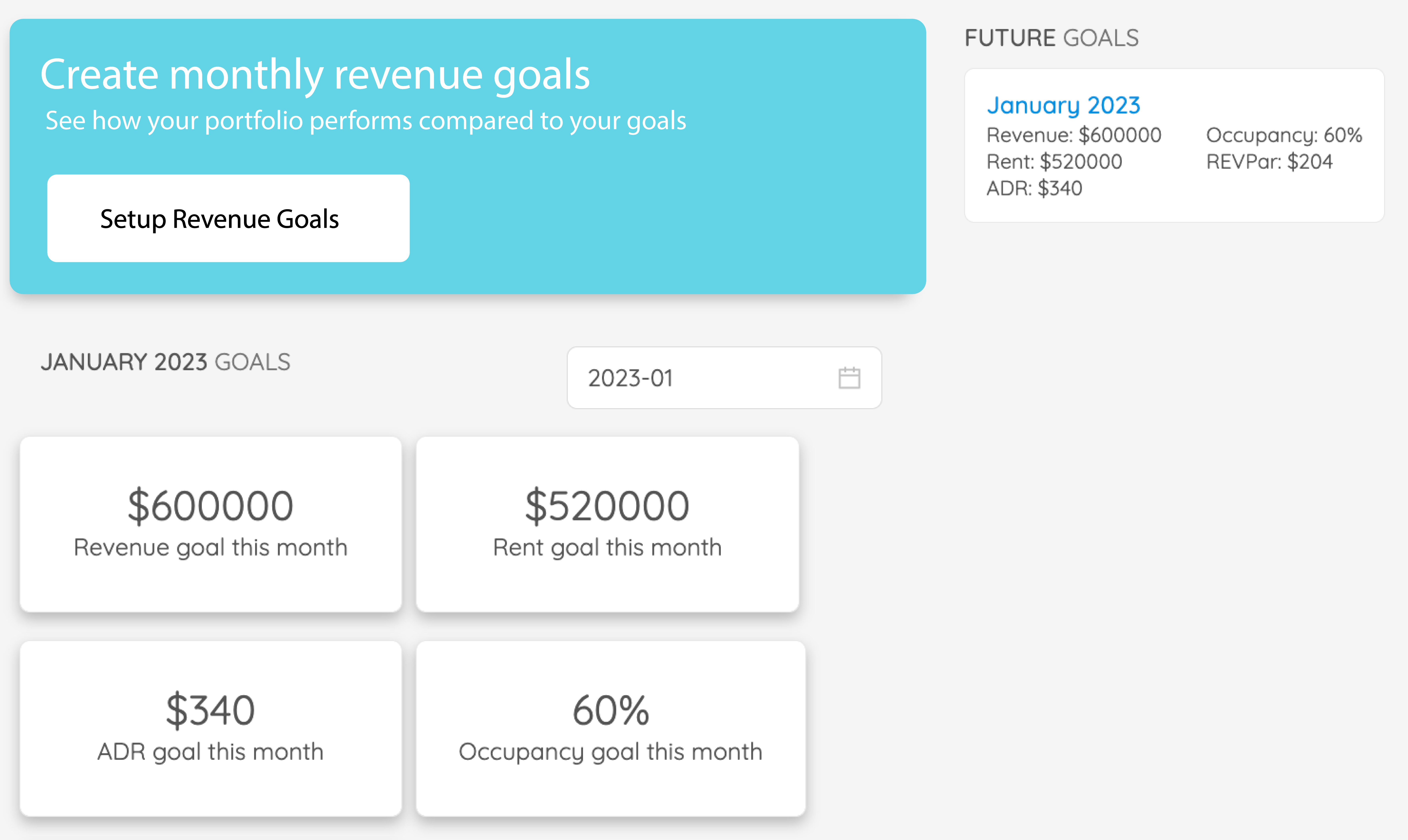

Tracking your progress is a great way to stay motivated and ensure you are on the right track with your finances. An excellent way to do this is by categorizing your finances from income, expenses, investments, debt, and savings. Consider using a budgeting application like quibble or a spreadsheet to help you keep track of your revenue intake. A budgeting app or spreadsheet can be a great way to help you keep track of your spending as well. Using one of these tools, you can quickly view your revenue in one place and ensure you stay on budget. With a budgeting app, you can often set alerts for when you reach certain spending limits or revenue targets, so you can make adjustments as soon as possible. Spreadsheets are also handy for tracking revenue. You can create custom formulas to analyze your spending patterns and ensure you stay within your budget. Make smart financial decisions and learn more by visiting us at https://hello.quibblerm.com/budgeting.

📊 You will have an easier time managing your finances since you will know exactly how much you can spend.

This will help you set a budget to stay on top of your finances. Setting and sticking to a budget can be challenging with the ever-increasing cost of goods and services. It can be difficult to adjust your spending habits and stay within the confines of your revenue projections. However, it’s essential because it helps you better grasp your finances. With a budget, you can plan ahead and ensure that your money is allocated to best serve your business’s needs. It can also help you save for long-term goals and avoid layoffs. Setting and sticking to a budget is essential to financial health and stability.

🎯 You will be able to identify areas where you can make cuts to save money.

Early planning financially can help you save money in several ways. You can ensure that you are putting money towards your financial goals and not wasting it on unnecessary items by thinking about your financial goals and budgeting for the future. You can also take advantage of deals and discounts available to you if you plan ahead. Additionally, planning and budgeting can help you to avoid costly mistakes such as overspending or not budgeting for unexpected expenses. By planning and budgeting for the future, you can ensure that your money is being used as effectively and efficiently as possible.

“By planning and budgeting for the future, you can ensure that your money is being used as effectively and efficiently as possible.”

🚀 It will allow you to set financial goals for the year and work towards achieving them.

An organized plan of action and a timeline will help you stay on track and take the proper steps toward achieving your goals. Additionally, it will help you be better prepared for unexpected expenses or changes in your financial situation. By analyzing your income, expenses, debts, and investments, you can create a realistic budget and plan that will help you reach your financial goals. Early planning is a great way to ensure that you’re making the most of your money and investing it in a way that will benefit you in the long run. So secure your financial future and start budgeting here.

“Early planning is a great way to ensure that you’re making the most of your money and investing it in a way that will benefit you in the long run.”

💎 Conclusion

By setting your budget now, you can identify areas where you may need to cut back or save more and adjust your spending habits accordingly. Furthermore, you’ll have more time to research cost-saving strategies and invest in methods that will help you reach your financial goals. Taking the time to set your budget now will mean that you are ready to tackle 2023 with a plan and the knowledge that you are making the best financial decisions for your future.

I hope these tips help you create a budget for 2023 that works for you! So, start planning your 2023 budget now; book a demo with us here, and we will help you get ahead of the curve!

Join our newsletter

Dominate the short-term rental market with cutting-edge trends