Our previous article was a detailed exploration of how Base Price Models work. That is a good place to start if you want to understand the industry standard pricing model for the short-term rental industry. I went through the reasons why I think this type of model was chosen 10 years ago when dynamic pricing was just getting started in the STR world. It is a very reliable and scalable model that will cause your nightly rates to fluctuate and follow the market. However, the model does not optimize pricing for maximum revenue, and that is where the previous blog left off. In this blog, I will explain the newest model being introduced to this market and the major advantages of choosing an optimization model to set your pricing.

What Each Model is Doing?

First, the term optimization has a different meaning in mathematics than it does colloquially. In normal conversation, we might use the term to mean “make something better or improved.” When we talk about it in math, it has a more specific meaning; in revenue optimization, it refers to solving a function to find the point of highest expected revenue. That is the meaning that is used in this article. This is the major distinction between the industry standard Base Price Model and the latest optimization model released by quibble.

By definition, this is what each of the models is designed to do:

Base Price Model: determines the amount or percentage change to make to a fixed base price.

Optimization Model: determines the price that maximizes the expected revenue.

Probability-Based

The first interview I ever had for a revenue management position was to be an analyst at Frontier Airlines. The most important question they asked me was this: which of these scenarios would you prefer?

- Pricing a seat with a 50% chance of booking for $250

- Pricing a seat with a 90% chance of booking for $115

If you studied economics in your undergraduate or if you like to gamble a lot, this question might be familiar to you. If not, the answer might not be intuitive. What you need to know is your expected revenue from each outcome. In the first scenario, you will get $0 half the time and $250 the other half. Your expected revenue in this scenario is 0.5*$250, which is $125. It is counterintuitive because you never would get $125, you would only get $0 or $250. But, if you were to run the simulation enough times you would end up with around $125 on average per outcome. The 90% chance in the second scenario seems pretty high, but let us calculate the expected revenue. The expected revenue is 0.9*$115 = $103.5, which makes scenario #1 the correct answer to this question.

There are multiple types of optimization models, and they all have this common element, which is the use of probability in the revenue maximization process. The objective of this model is to solve for the price that maximizes the expected revenue. As you change the price, the probability that someone will book also changes.

Business Rules

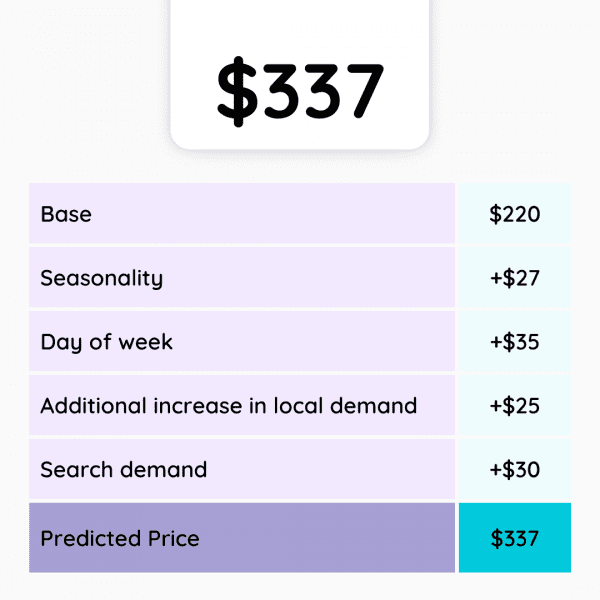

Similarly, there are multiple types of rules-based pricing systems. Base Price models fit into this secondary category. Instead of probability-based pricing, rules-based pricing sets prices based on certain criteria. The criteria are normally defined as the “if-then” type of statements. In the example below, there is an image of a typical Base Price model. It gives you the starting point which is the Base. Then it says “if season = X, change price by Y amount.”

Base Price models are more of a heuristic price-setting process. They do not look for the price that has the highest expected outcome, and that is not their objective. The changes made by this model are normally logical, but cannot be called optimal in this mathematical sense.

Trend Toward Business Rules

In the mid-2010s, there was a trend towards using a more rules-based system in airline revenue management. This was largely driven by the fact that the probability estimates created by the optimization models were no longer as accurate as they once were. The industry was shaken up by new low-cost carriers and capacity fluctuations. These models are heavy and require extensive processing, so when their utility decreased, the market searched for alternatives. Although the STR market is structured quite differently, this same type of problem may be the reason the STR industry settled on business rules instead of optimization models.

In the interview example above, there were two probabilities given: 50% and 90%. Those probabilities were meant to describe the probability of an event occurring, and they were estimates from historical and future data. If the probabilities are off for any reason, the pricing would be off as well. Getting these probabilities right is very hard, so dynamic pricing in the STR industry skipped the probability model (optimization) and went straight to business rules.

Trend Back to Optimization

The biggest and most sophisticated airlines never made the switch to business rules because they had teams of analysts to correct the errors in their data. They had also made huge investments in their optimization models. When I was at Virgin America, we started pricing with an optimization model. We transitioned to a rules-based system because of all the problems described above. Eventually, we created our hybrid pricing model to reincorporate the optimization model. The trend back is largely driven by the power of the optimization models. A lot of effort goes into setting them up right, but once you do, they will outperform business rules consistently.

This trend towards optimization in the STR pricing market is being led by Quibble. We have introduced the first optimization model to the industry for property managers to maximize their revenue. To do this properly, we had to introduce an optimization model that is just in its infancy in the airline industry.

Binary Booking Problem

Hands down the biggest challenge to using an optimization model in this industry is getting the probabilities right. We had to take a completely different approach to solving this problem. Traditionally, revenue management models are forecasting the amount of bookings that will occur. For a hotel or an airplane, this is a very different problem due to the capacity of each.

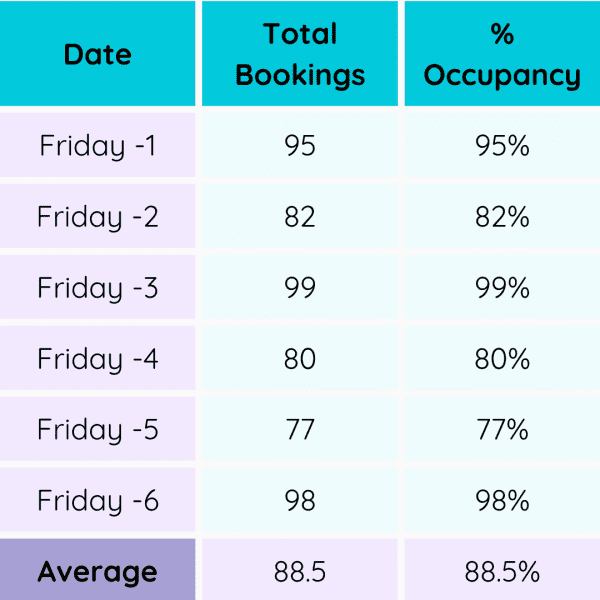

To forecast how many bookings a hotel will take for a given night, it is possible to look at a group of historical nights and see how many bookings they took. For example, the Downtown Hotel wants to forecast the number of bookings they will have on an upcoming Friday night. The Downtown Hotel has 100 rooms, and the last 6 Friday nights have an average of 89 booked rooms. 89 bookings or 89% full is a reasonable estimate for that Friday night.

Running this example on a single listing looks different because there is essentially only one room. So, the property is either booked or vacant. There are no 89% full nights at the listing level. It is not impossible to estimate the probability that the listing will be booked on a Friday night, but the historical data is fraught with issues. Owner bookings, cleaning blocks, maintenance blocks, to name a few issues. But the biggest problem is that there is no opportunity to re-forecast the probability if things materialize differently than expected. If you forecast 89 bookings the revenue manager has the chance to watch the first 20 bookings and then adjust the forecast. The STR problem is binary in that respect, with no chance to correct it.

Choice Model

A rule-based model would probably outperform this type of optimization model because the forecasting is so hard and has so much variability. The approach we took to solving the binary booking problem was to forecast something different. Traditionally, revenue management models forecast final demand, or the number of reservations that will exist and not get canceled at the final position. That type of forecasting and optimization wouldn’t work very well with this type of inventory because of the binary nature of the problem.

What the quibble optimization model is built to forecast is the choice a shopper is going to make when your listing shows up on their screen. This is different from forecasting final demand because your listing can appear many times in front of many shoppers. Each event represents a chance to get booked, and this is what the model is optimizing for. The model can estimate the probability of you getting booked and your direct competitors.

This is exponentially more complex than a rules-based system or a traditional revenue management model. But the advantages are twofold. First, the pricing model uses probability and maximizes the expected revenue. Second, the model instructs you on how to capture more market share because it knows how to help you raise your share against your competitors.

Solving the Optimization Problem

The reason they are called optimization models is because they find the optimum price point that maximizes your expected revenue. To do that, the model needs to test the expected revenue of each possible price point, it doesn’t stop until it finds the maximum point. But, when you change the price it changes the probability of someone choosing your listing. It also changes the probability of your competitor getting booked. So, it is a complex problem that needs to be solved every night for every property.

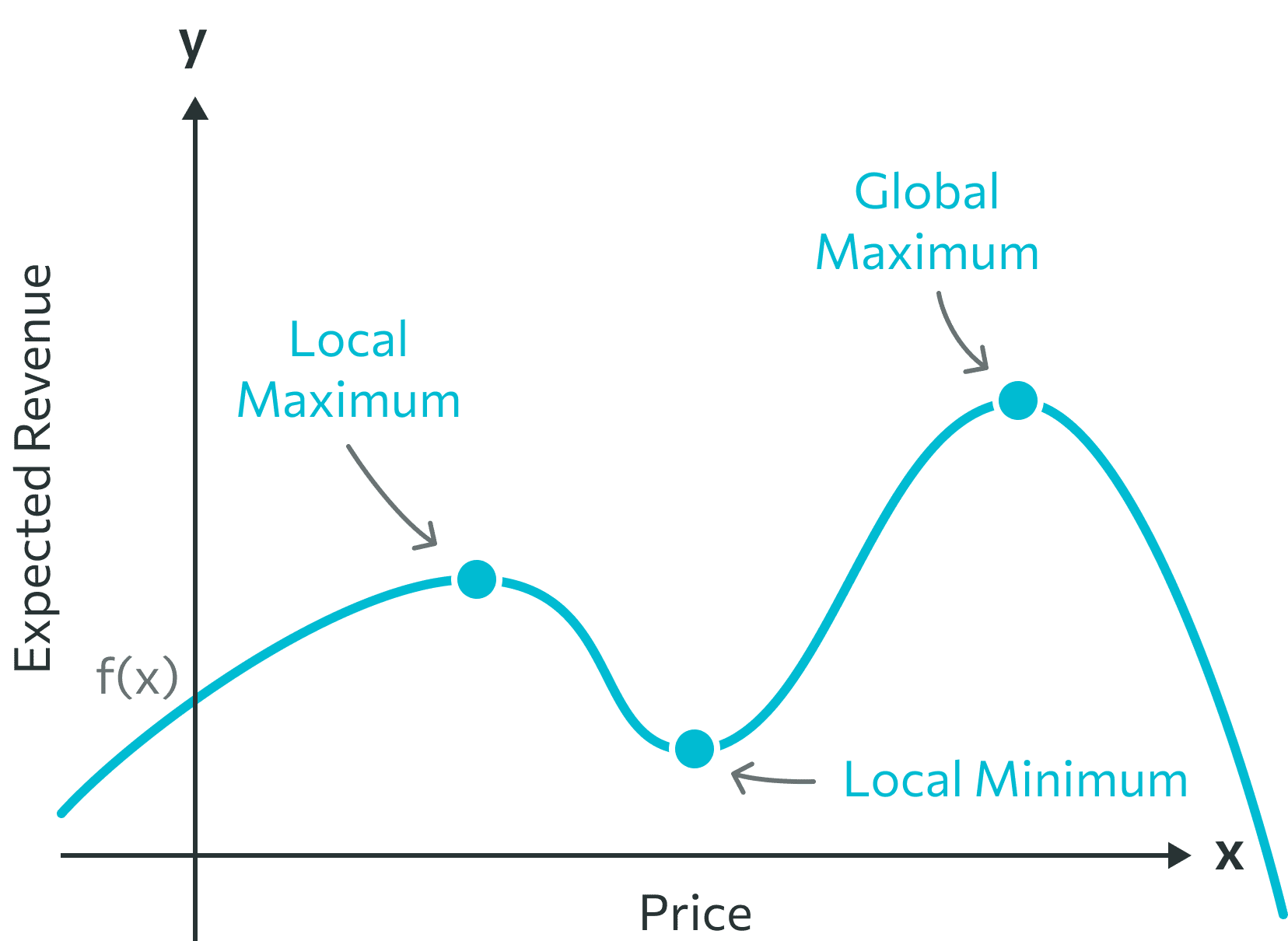

Looking at the expected revenue graphically helps to visualize how the model iterates through the possible options. Starting at the origin and moving right, the expected revenue is on an upward trend. This trend continues to the Local Maximum. This would be a reasonable place to stop because if you move in either direction on that line the expected revenue will decrease. But if the model pushes through and keeps going to the right it will find an even higher point on the function. This is the highest point that the function will ever reach and is the Optimized Price for this night.

Complexity vs The Gains

The quibble optimization model is the best pricing science available in the market for pricing your STR. But to adopt this technology into your business adds complexity. If you are moving from manual pricing or moving from a Base Price Model, this is going to be more complex. Implementing a model like this can take up to six weeks, and you will have to work with our implementation team to get it all set. But, the gains are significant both in improving your pricing and in helping you to optimize your listing.

If you are interested in learning more, set a meeting to talk to an implementation consultant.