Search Data in Short-Term Rentals and Vacation Homes

I. Introduction

Marketing and pricing professionals are always looking for powerful data sets to help them make better decisions. Knowing who or how many people are searching for a short-term rental property like yours could be one of those powerful data sets that helps them market or price better.

In this blog, I explain what I have seen over the last 12 years in pricing and revenue management regarding search data and conclude with how we have decided to use our version of search data to enhance our pricing.

II. Understanding Search Data

The premise of search data is this: if a lot of people are searching for a specific type of property in a specific location, there must be high demand in that location for that date range. This premise seems completely logical. Why would people be searching that area for those dates if they weren’t interested in booking them? Therefore, we better increase our rates, right? The answer, unfortunately, is maybe.

Defining what constitutes a valid search is not straightforward. In my experience, that is because the more you drill down into what a “search” is, how it is collected, and what it is compared against, the ambiguity of the data becomes more clear. From my lens, as a revenue manager, I am looking for very specific data as to what I would qualify as a valid search. If the data is going to cause me to adjust the price, it has to be very precise as to what it is saying. The same is true for marketing investment; marketing spending should be backed by good data.

My definition of a single search would look like this: Listing X, which I am optimizing pricing for, was displayed to a human being for a specific travel date Y. As you will see, the data is rarely this good, and one needs to be very careful when using search data for pricing or marketing.

Where is the search taking place?

One of the biggest challenges to getting accurate search data is that consumers are searching for listings on different platforms. The most generic type of search could take place on something like a search engine, say Google for example. A very specific type of search could take place on a direct booking website, like your .com site. In between those two would be the OTA’s, which to the dismay of property managers around the world, make up most of the actual searches. Let’s look at each of these a little deeper.

-

Google Search

Google Search

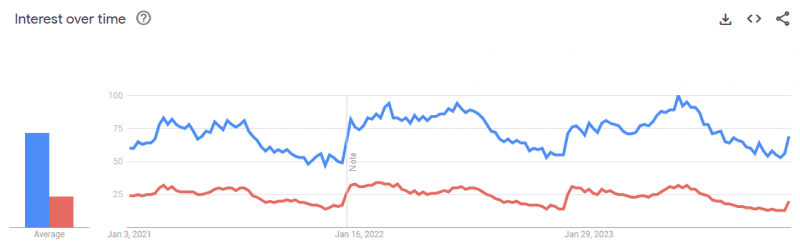

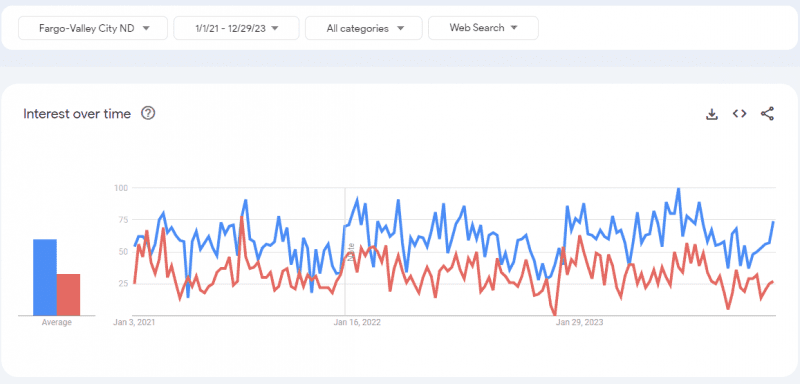

Google search data is incredibly accessible through Google Trends. This is by far, the easiest data to access for search metrics. Trends allow you to look at the popularity of any search term that you are interested in. For example, the below chart is a three-year historical view of the search terms “Airbnb” and “VRBO.”

Viewing this data as an analyst, it passes some basic logic tests for reliability. The curves have the same basic shape, which indicates that the search terms are highly correlated. It also peaks where I would expect, both charts have peaks in the summer period, where travel peaks in the US.

The problems with the data though start with the specificity of it. As a pricing strategy, you want to get as specific as you can safely do when adjusting price. If you drill down to a city-level view, like in the next chart, the data can start to look more like noise than like a trend, particularly in areas where the search is pretty small:

This also indicates a search that happened ON a specific date, not FOR a specific date. As a pricing professional, you don’t want to wait for the search data to peak before you raise the rates. That would almost guarantee that you missed your opportunity. The nature of this data makes it historical by nature, meaning people are searching for these terms today but we don’t know what travel dates they want.

Google Trends data is an interesting data set and could have applications in market research. But, it is not suitable for use in pricing or marketing efforts.

-

The OTA’s

The OTA’s

The OTA’s would be an incredibly good source for this data. When someone searches for a property on one of the OTA platforms like Airbnb or VRBO, they have an algorithm that determines which properties appear in that search and in what order they appear. Therefore they know how many times your property ended up in a search, who the competitors were in that search, what page you were on, if someone clicked on your property, etc. The OTA’s just aren’t sharing that data with the property managers at this time and I’m not sure if they ever will.

-

The bots problem

The bots problem

Let’s say, hypothetically speaking, that the OTA’s were willing to share this data with you. They have a pretty big problem because the data they would share would be highly tainted with bot activity. Sites like booking.com and VRBO are being constantly bombarded with computer robots visiting their sites and collecting data.

Your property may show up in a search in front of a human being who was shopping for a vacation home for an upcoming trip or it may have shown up in a robotic search that was collecting data on every single listing in the entire United States. At the moment, these platforms cannot tell with any certainty which was which. The latest data from Statista suggests that 47.5% of all web traffic in 2022 was done by bots. If half of your search data turned out to be bots it could easily lead to some bad pricing decisions.

-

Direct

Direct

Direct bookings are the preferred method for property managers for many reasons. The search activity that occurs on your direct booking sight is also the best quality data you can get. It includes all the key metrics we wanted from the OTA’s but they are not willing to share. As the property manager, this is your data so you should be able to use it as you please.

There are a few challenges with the direct booking site data, and the first is collection. Most of the time (in our experience), the booking engine is provided by the PMS and storing and sharing this data is not a service most of them provide. So, to get this off your direct site you need some programming savvy.

The second issue is that even after you collect the data it will only represent the portion of the search that occurs on your direct channel. This probably means that you would be missing the lion’s share of searches that are occurring for your listings.

-

Intent

Intent

Revenue managers have been trying to use search data for a long time. I started using this data over 10 years ago at Virgin America. We were hoping to get an early signal of intent. Many times people will shop a trip a few times before they make a purchase. We assume they intend to purchase at a later time and if a lot of search is occurring it would eventually convert.

The primary metric we looked at was the “look to book” ratio. The “look” is a shopping session where they would look at an itinerary. The “book” was the conversion. If there was high conversion comparatively, we assumed that there was a strong demand.

Searches for airline tickets have the same problems as described above for short-term rentals. The points of distribution are numerous and you only can collect data on your direct channel. That is pretty limiting. The data scraping problem also dirties the data. We eventually stopped using the data for pricing because it was just not clean enough and what we wanted to infer from the data was intent. The signal just isn’t clean enough to do that with search data that has points of distribution that you don’t control.

💎 Bookable Search™

Bookable Search™ was created by quibble to overcome the obstacles to search data and effectively implement the data into our pricing model. We had to redefine what the search was to make it useful. We coined the term Bookable Search™ to better describe what we mean by search.

Most of the shopping sessions that qualify as a search are robots, so we wanted to eliminate that data. This is second to shoppers who have no intent to buy but are just looking around, looky-loos. When you eliminate bots and looky-loos, all that is left are the shoppers who are serious about making a reservation and these are the only searches we care about. Searches that do not terminate in a booking don’t represent demand, in the revenue management sense of the word.

When we say bookable, we mean that your property was displayed in a search where the shopper DID purchase. They may not have booked your property, but they booked something very similar. The consumer who booked something very similar to your property is the consumer whose behavior we are looking to understand in the search data. We have eliminated the bots and the looky-loos because they never terminate in a booking.

Once we have the Bookable Search™ data, we have a true demand signal. This data is plugged into the quibble choice model to improve the pricing. The metric does more than just predict demand, it is actually predicting how many times your listing will end up in a search. Not just any search, but a Bookable Search™ where someone is ready to buy!

Want to learn more about Bookable Search™?