What’s on this page:

Introduction

Plane tickets are almost always more expensive if you buy them last minute on legacy carriers. This is because airlines have much more strict pricing segmentation than other industries in travel, including the STR market. 2 phenomena are occurring that cause the prices to increase as you get closer to the departure date.

First, as more inventory gets purchased, the cheap seats run out. There are only so many seats available at each possible price point and the cheaper ones sell first. So if you shop for a ticket only 1 day in advance, there is a good chance it will be priced high.

Second, airlines enforce Advance Purchase rules in their pricing strategy. These rules normally apply at 21, 14, and 7 days to departure. That means that some of the cheaper price points will not be valid to price even if they are technically available. Meaning, there could be a lot of seats left on the plane, but the discount rates won’t price.

Short-term rental (STR) operators have the complete opposite strategy in their pricing. As you get inside 21 days, many operators are starting to drop their rates. They may continue to drop the rate programmatically until the inventory spoils. There are several reasons for this, which I will discuss here, but I will mainly argue that this practice should stop.

“Many operators are starting to drop their rates as they get inside the 21 days, but I will mainly argue that this practice should stop.”

Airlines vs STR’s

I make this comparison a lot between these industries because I have a long background in the airlines and the pricing strategies and technologies are more established in that industry. But, these are very different markets, and pricing strategies are not the same. There are pricing strategies that do not make sense to implement in this market.

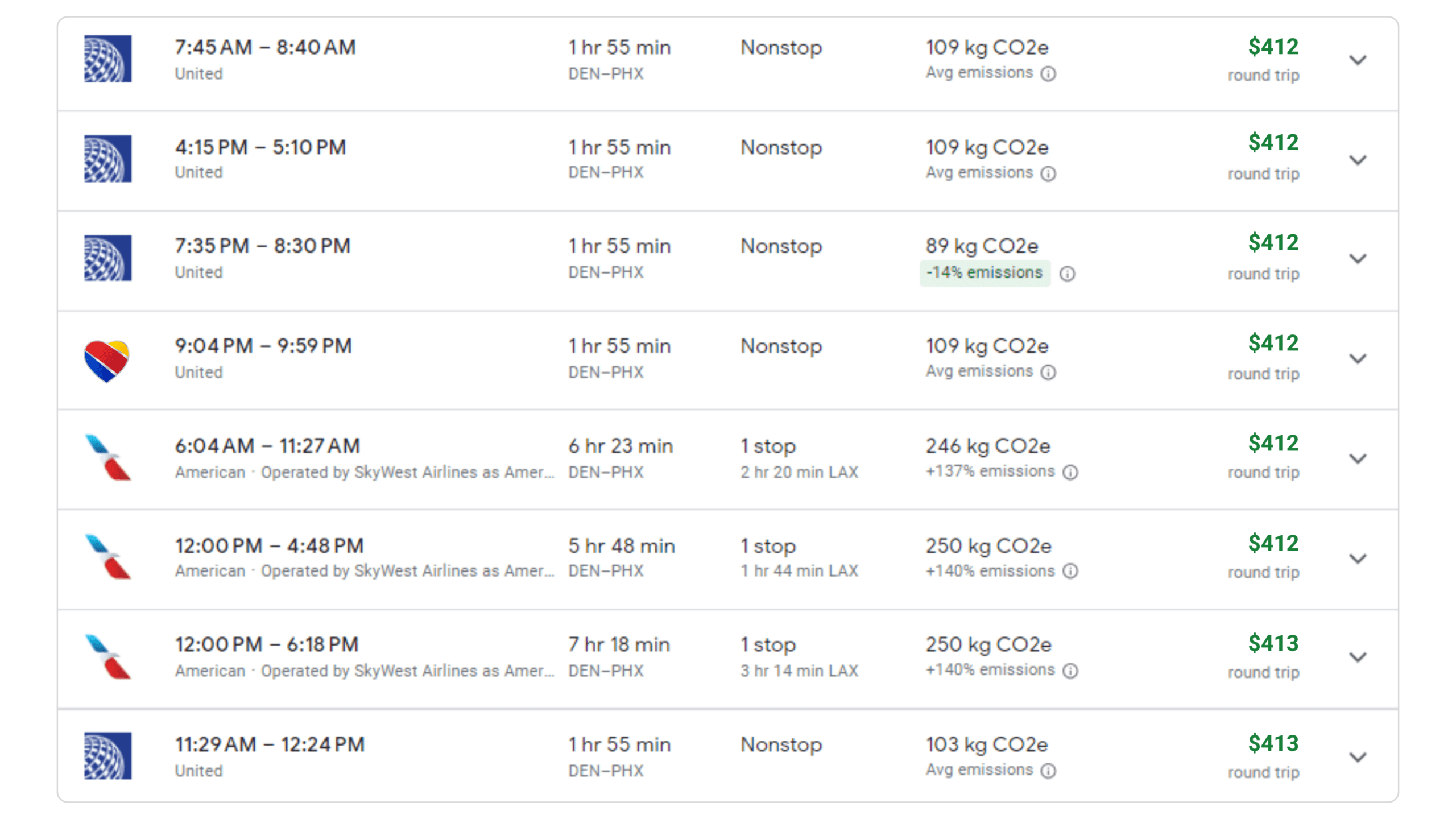

The nature of the competition is very different between the two industries. If you want to take a nonstop flight from Phoenix to Denver, there are 5 different airlines you can choose from. If you want to stay in a short-term rental once you get to Denver, there are over 1,000 options available. The airlines have a much easier way to compare their inventory, product, and pricing with each other because there are so few options in comparison.

“The airlines have a much easier way to compare their inventory, product, and pricing with each other because there are so few options in comparison.”

This makes the pricing strategies much more collusive in the airlines than is possible in the STR market. If the airlines want to sell in the GDS, where all the OTA’s get their inventory, they will file their prices publicly. So, all of the competitors can see the price changes and then match the price changes.

Below is a screenshot of a search for a last-minute flight DEN-PHX:

The reason the prices are all the same is not an accident, it is because they all know each other’s filed fares.

This search was for a flight 2 days away and the airlines are all holding at the same price. But, in the STR market, the exact opposite is happening. Property managers and revenue managers are frantically dropping the rates trying to capture any last-minute demand that exists in the market. The airlines are colluding and the STR operators are ruthlessly and thoughtlessly competing to steal market share.

“The airlines are colluding and the STR operators are ruthlessly and thoughtlessly competing to steal market share.”

Why Don’t Airlines Discount Last Minute

There are two prominent strategies in the STR market when it comes to last-minute pricing. First, is the “do nothing” strategy. A flat pricing strategy. The second is to discount the listing last minute. At some point before the inventory expires, the manager starts a discounting program that lowers the rates.

The first reason is called segmentation. Revenue managers in the airlines normally think in terms of business passengers and leisure passengers. Both of these segments have different price elasticity and willingness to pay. The last-minute pricing strategy exploits the high price inelasticity of demand for passengers who do not book ahead of time.<

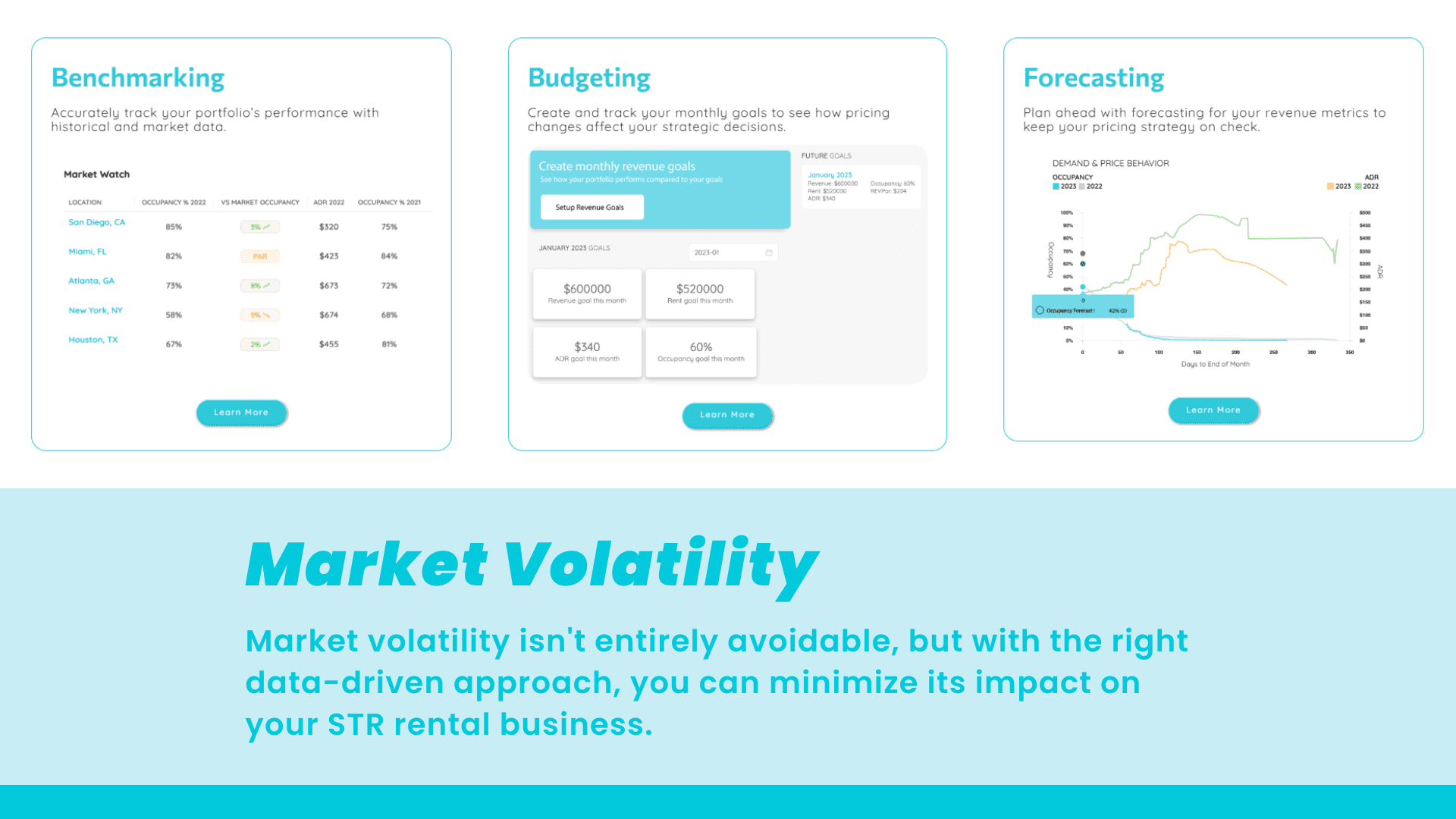

Second, the airlines use a different kind of pricing model than what is available in the STR market (until quibble came along). This is called a forecasting and optimization model. The airlines have a forecast or estimate of how many passengers are still yet to come, this is called remaining demand. With a good remaining demand forecast you can have a lot more confidence in the revenue that will be generated from that last-minute demand.

Why do STR’s Discount Last Minute

There are two prominent strategies in the STR market when it comes to last minute pricing. First , is the “do nothing” strategy. Basically, a flat pricing strategy. Second, is to discount the listing last minute. At some point before the inventory expires, the manager starts a discounting program that lowers the rates.

The general purpose of the strategy is to try to fill inventory that would otherwise be empty. I would consider this an occupancy-based strategy because it puts a greater emphasis on booking the nights than maintaining the price. This is a very tough market to compete in. If a listing doesn’t have a booking yet, and time starts to run out, dropping the price is something that you can do very quickly and cheaply.

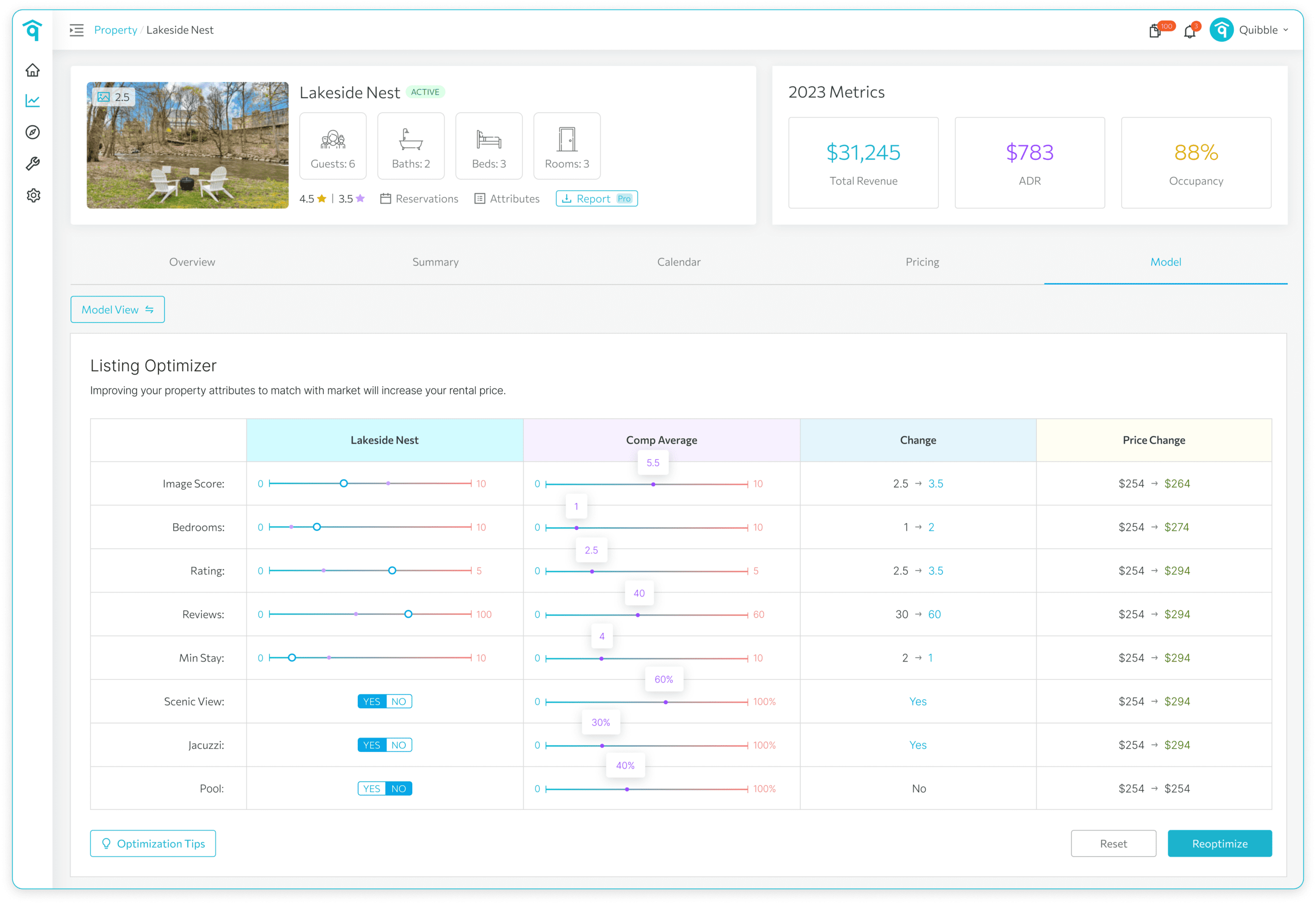

Other solutions are much more long-term and expensive, which I think is another reason this is such a pervasive strategy in this space. A lot of what we do at quibble is to design software that not only optimizes the rates but guides the manager to the listing improvements that are needed to increase the rates.

The problem with these opportunities is that most of them are not short-term solutions. If the quibble model recommends that the listing needs to improve the marketing photos, that is a time-consuming and expensive fix. Similarly, if the model recommends improving your listing rating and investing resources into this listing, that too will take time and money. Both of these opportunities can be quantified inside the model and are likely worth the effort. But, they take time. A price reduction can happen in seconds which is another reason it is so attractive for last-minute discounting.

How to Turn Off your Last-Minute Strategy and Make More Money

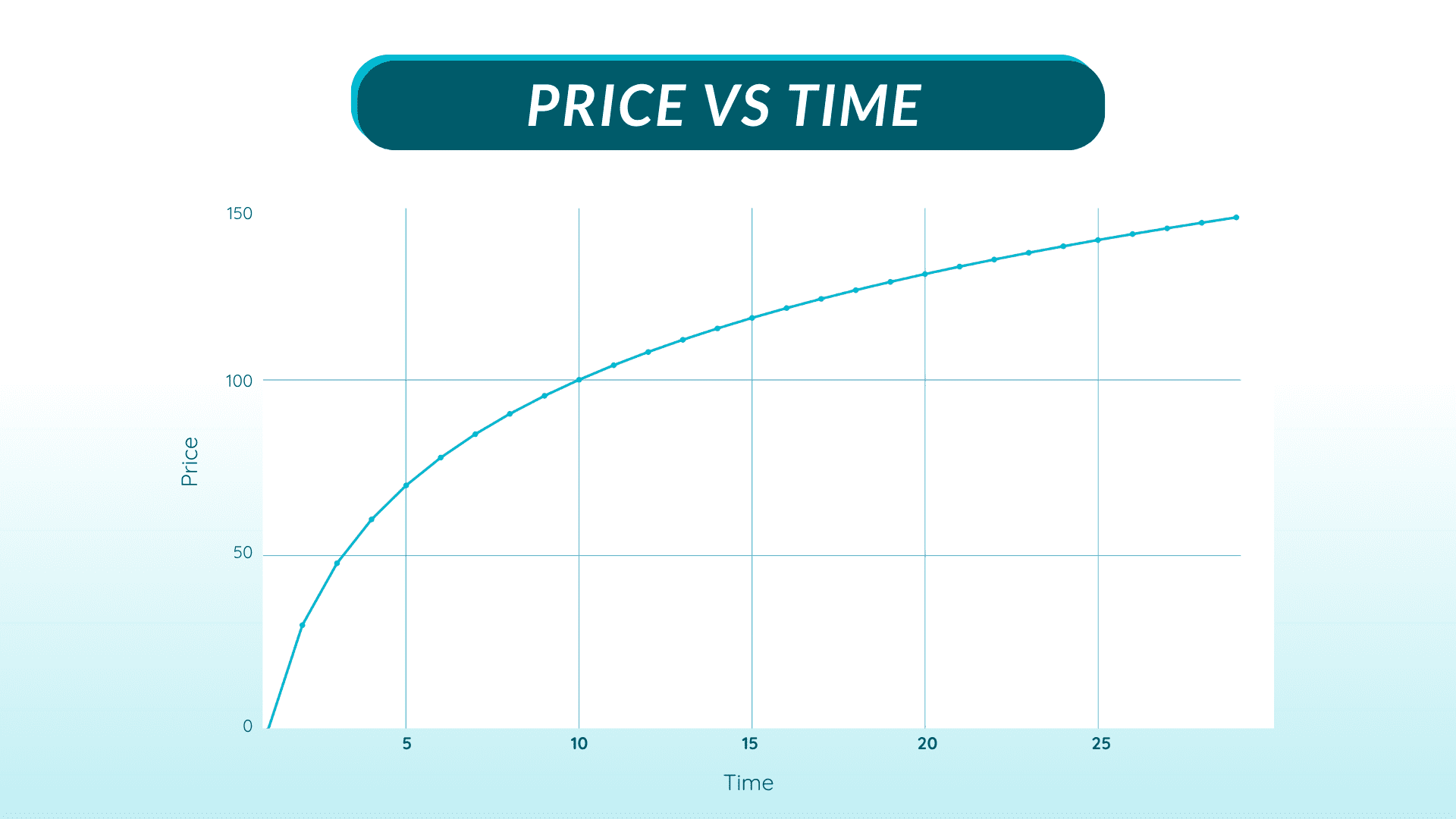

I will admit that I have a strong bias against last-minute discounting. This is 100% because I learned how to do revenue management in the airline industry. When a flight is well managed by the pricing and revenue team, the price will gradually increase over the life of the selling window. If the price rises dramatically, that is a really strong indicator of something going wrong. If the price of the flight ever decreases, this means your original forecast was off and you were forced to reduce the rate. The bigger the price drop, the more the forecast was off.

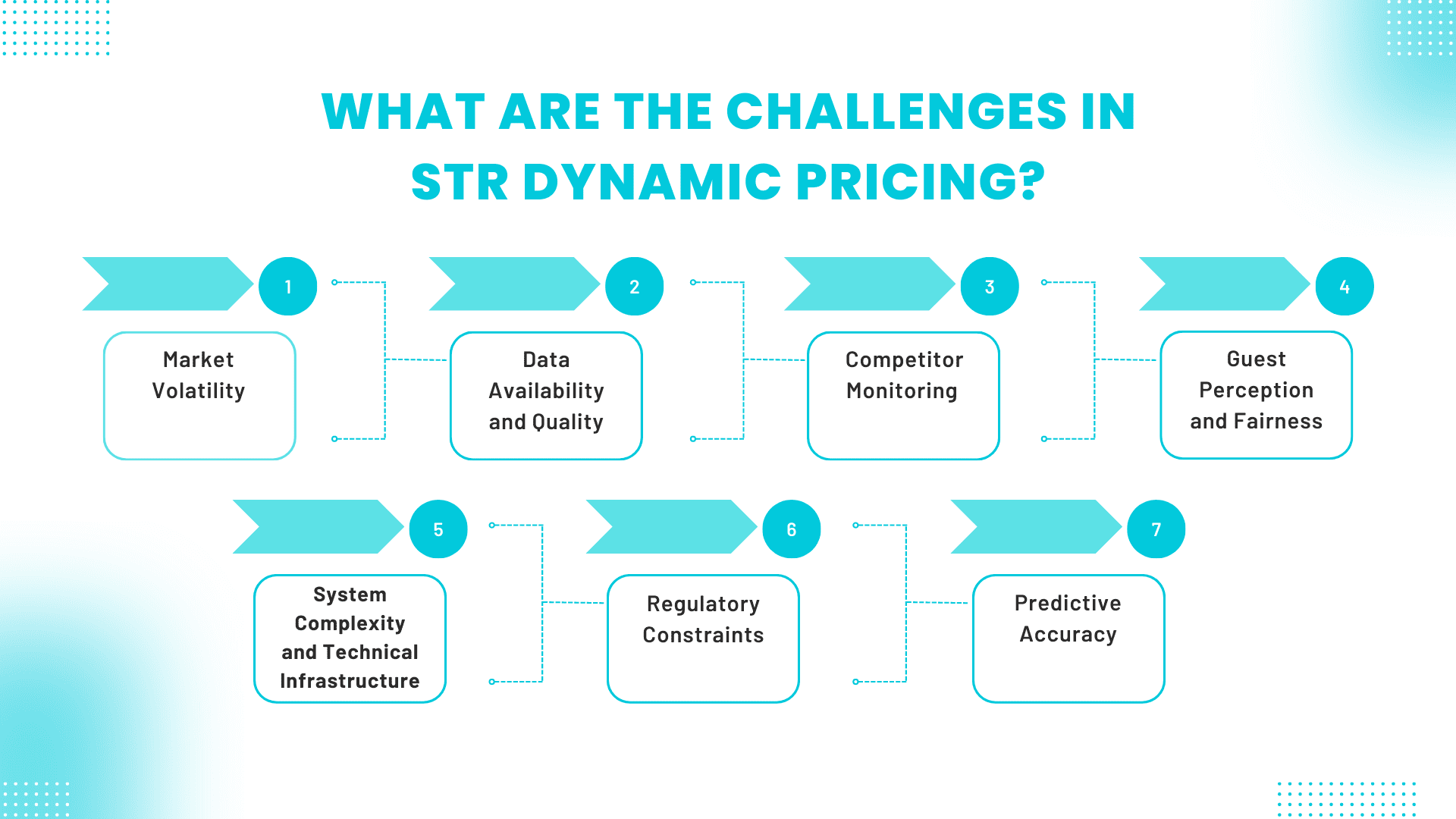

That is the lens which I view this last-minute discounting strategy through. Discounting is due to poor forecasting or no forecasting. In the STR market specifically, it is due to no forecasting. Until quibble released RevenuOS there was no available pricing model for STR’s that did forecasting or optimization.

“Discounting is due to poor forecasting or no forecasting. In the STR market specifically, it is due to no forecasting.”

When you are using an optimization model, which requires forecasting, last-minute discounting is unnecessary and will only reduce your total revenue. The big advantage of using an optimization model is how it deploys probability (forecasting) to set the rates. Quibble is optimizing the rates based on a forecast of when your property will next end up on the screen and who else it is competing against. Adding a layer of discounting to the output cannot improve the price, so we don’t even offer this functionality in the product.

“When you are using an optimization model, which requires forecasting, last-minute discounting is unnecessary and will only reduce your total revenue.”

Downward Spiraling

The problem of programmatic last-minute discounting is worse than it appears. We have seen large companies with professional revenue teams have scheduled discounting for all of their properties. This causes unsold inventory to be discounted with no other consideration besides that it is close to expiring. That alone is problematic, but it has a big effect on the rest of the market.

Imagine a scenario where you and everyone in your city are using a base price model and a programmatic discounting strategy. If half of your competitors start a programmed discounting scheme 2 weeks before the inventory spoils, it will drive down the average market rate scrapped by the base price model. That will cause your rates to decrease. Then, let’s imagine you have a discounting policy that starts at 1 week before the inventory is spoiled. Your pricing will be lower because your competitors drove down the market rates, and then you would be further discounting your rates. Then, the scraper picks up your new reduced rates and takes the pricing down even further. And prices spiral downwards out of control.

💎 Solution

Last-minute or close in discounting is a pervasive problem in the short-term rental market. Many property managers and pricing professionals in the industry do not have the right tools to forecast and optimize their revenue. There is plenty of confusion in the industry, where managers who use dynamic pricing think they are optimizing their revenue or pricing. The only way to optimize your rates is with a robust forecast/optimization model. By choosing the right model, you can walk away from last-minute discounting and rely on solid pricing science to set your rates.

Join our newsletter

Dominate the short-term rental market with cutting-edge trends