What’s on this page:

Introduction

The base price model has dominated the market for dynamic pricing offerings in the STR market. It is not discussed that much because it is assumed by many to be the only way to do dynamic pricing. If you have never worked in another industry that has dynamic pricing, it is quite reasonable to assume this is just the way it is done. But that is not the case, there are many different ways to do dynamic pricing and the base price is just the option that our industry has been forced to accept.

“The base price model has dominated the market for dynamic pricing offerings in the STR market, often assumed to be the only way to do dynamic pricing.”

What is the Base Price model?

A base price model is a simple form of dynamic pricing. Simple in the sense that they do not use a forecast or optimization step like more sophisticated modes in pricing and revenue management. The model allows a user to set a “base price” for a property and then determines how much to adjust that base price up or down based on the cost of the competitors in the market.

They can avoid the forecast and optimization steps because the model itself does not know what the price is. The model does not need to know what price is to run. It is simply trying to calculate how much, or a multiplier, to move the set base price.

“A base price model is a simple form of dynamic pricing, avoiding the forecast and optimization steps that more sophisticated models use.”

How Does a Base Pricing Model Set the Price?

The reason these models need so many competitors is a function of how they are built. They are trying to get an average of a broad market price, then use that average to manipulate the base price up and down. If the model uses a big dataset, 500 to 1,000 listings, it eliminates a lot of the noise that can be caused by data fluctuations.

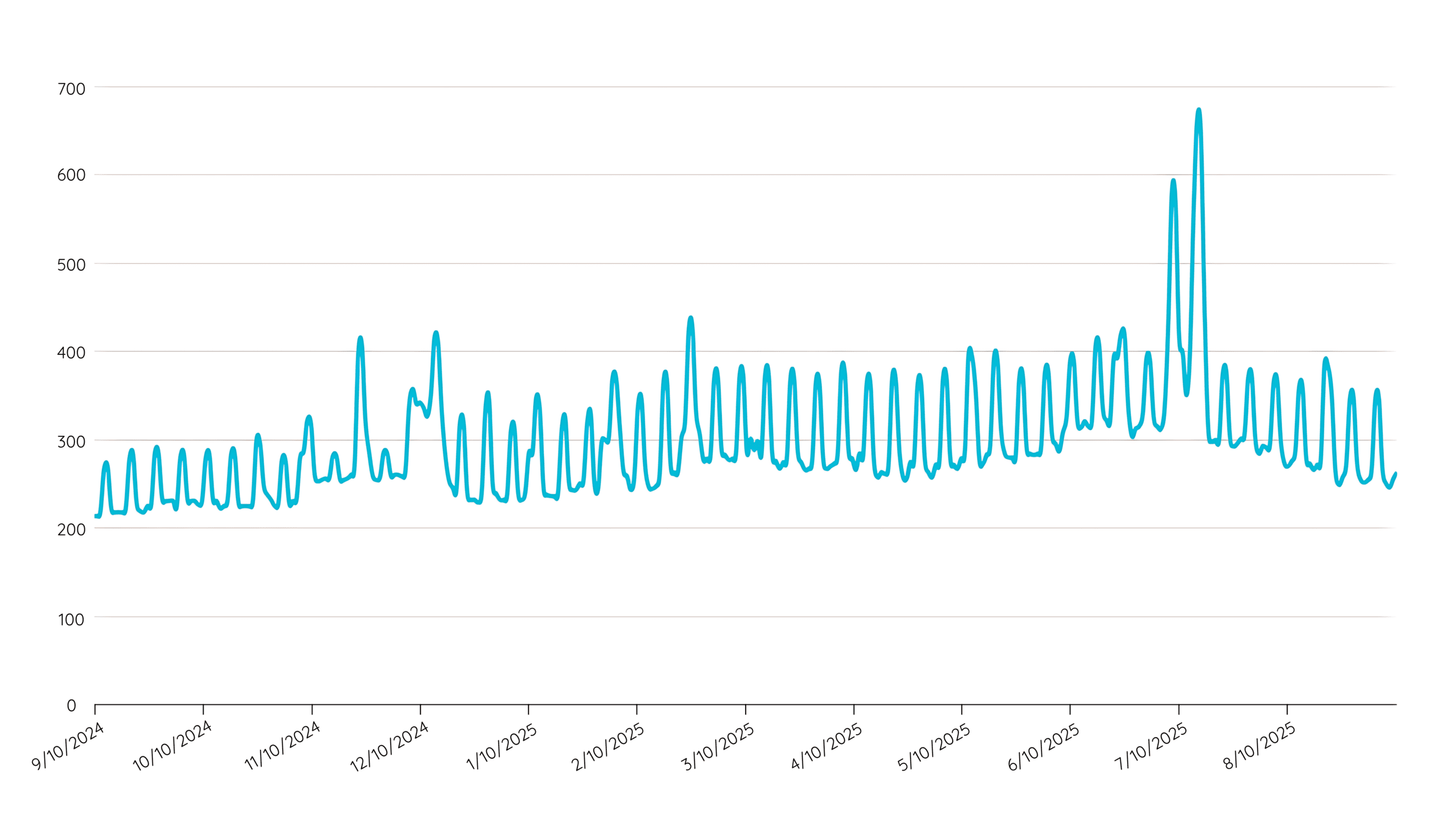

Here is an example of the forward-looking scraped data for 1,000 listings:

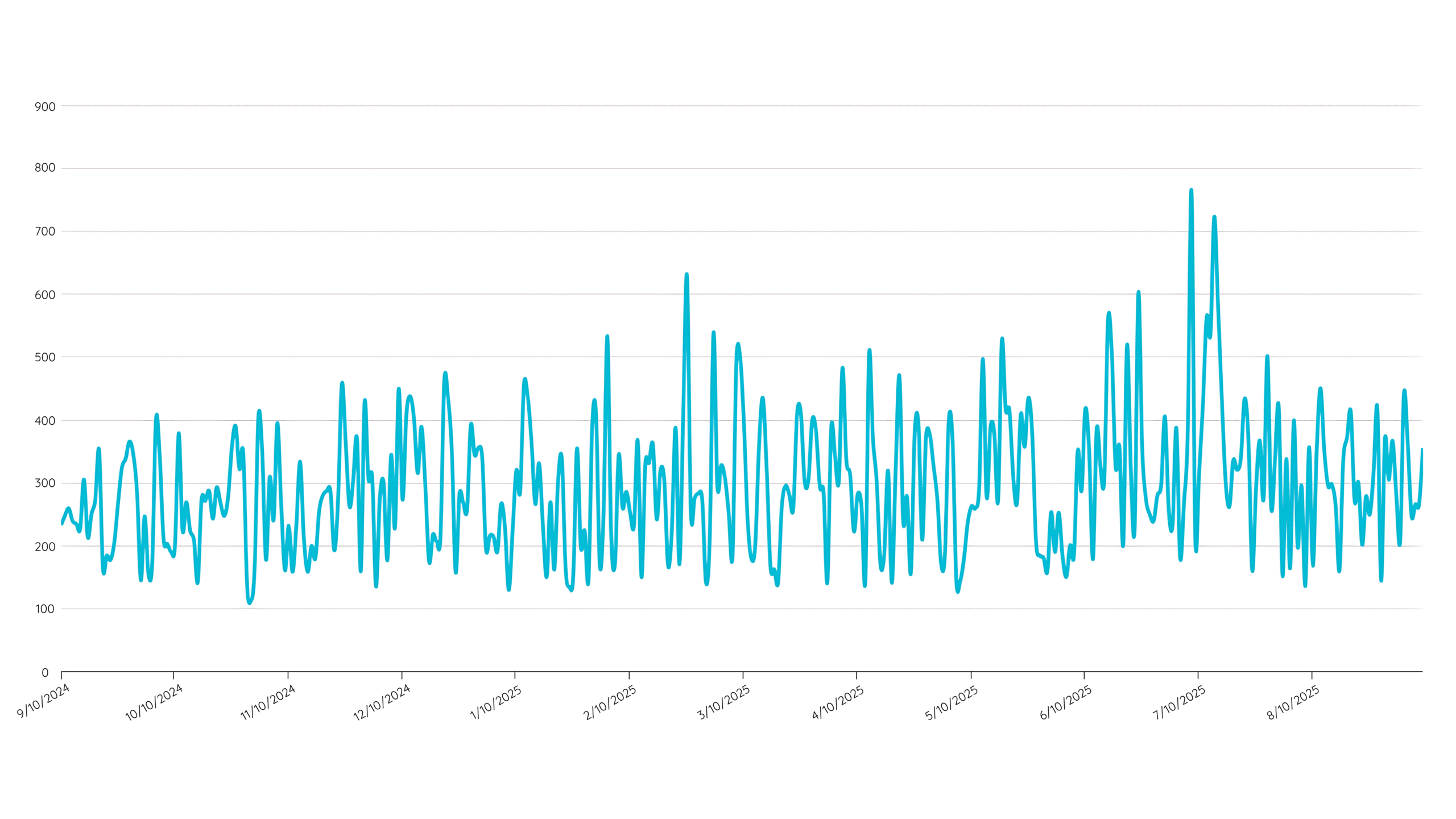

Here is an example of the forward-looking scraped data for 10 listings:

If the base price model uses the 1,000s of listings, it can create a much smoother forward pricing curve. That smooth price curve is what it is looking for because the price that it is going to set for your listing is just a function of the average price. The big number of listings tamps down a lot of the noise and allows the model to take advantage of broad market trends.

What happens if you want to……just use comps in your isolated market? In many, if not most, cases the broader market doesn’t do a good job of determining how you should price. Following the trend of the 1,000’s might not be how you want to deploy your pricing strategy.

As you start to reduce your comp set in the base price model, you could very well pick up on more local trends. But, as you can see in the chart above, the model can become too responsive and erratic. To keep the pricing behavior consistent and predictable, the base price model needs a lot of comps.

Why Were They Built This Way?

When you look outside the STR market, to the industry in which I started my pricing journey, the airlines, there is a similar phenomenon. Airline pricing models (excluding business rules engines) are all the same. They all use historical data for forecasting demand for future flights. They use similar untruncation models to improve the demand forecast. They all use a form of marginal seat optimization for setting protection levels. I know this because I have used Pros, Sabre, and airRM as an analyst. They all do the same thing in the same way.

This is exactly how the STR market has adopted the base price model. Every base price model runs the same basic process, and it is much simpler than what airlines are doing. The differences you may see are in marketing and interface. If you have the time, you can build one of these models in Excel.

I think there are 2 primary reasons that the industry is dominated by this pricing model. First, building a more sophisticated optimization model is very hard. If your customers are willing to settle for something like this, you can save a ton of money in research and development in the early stages of setting up. The second reason is that base price models are easy to scale. You can get them to work almost anywhere there is a vacation rental market. The model does not require any historical data, it doesn’t need to process revenue, or convert currencies, and they can be deployed very easily just about anywhere.

The Disincentive for Innovation

Over the last ten years, the STR market was given two options, the base price model or manual pricing updates. Just like in the airlines, when all the major providers have the same model, the innovation is isolated to that accepted model. Once there was broad adoption of that model, it became accepted as the way of doing things and became hard to change.

Building the next base price model is incredibly simple. The technology underlying the model is easy to replicate. There are several vendors and multiple PMS systems that have built their version of the model. At the moment the PMS has the advantage of being natively integrated, while the external offerings are much more feature-rich. But, they are all using the same model.

💎 The 3rd Option

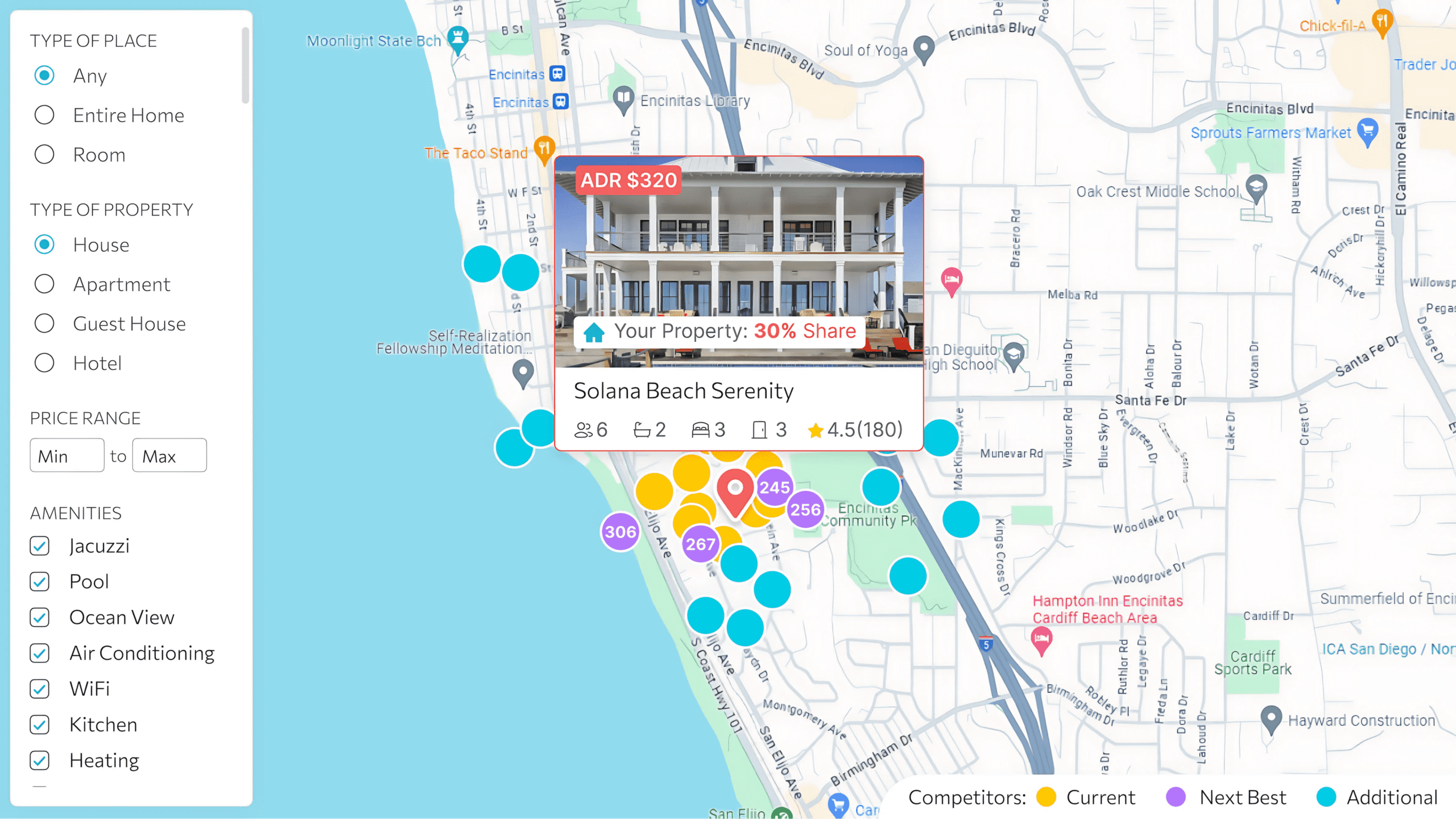

There is now a third option—the Quibble optimization model—which has completely done away with the base price model and its restrictions. It has solved the problem of compsets because it uses a different process to control price. The total comp set is between 10 to 15 listings.

Join our newsletter

Dominate the short-term rental market with cutting-edge trends