🏁 Getting new properties

As a property manager, growing your inventory is one of the primary drivers of increasing your company’s revenue. However, attracting these properties is a unique endeavor of its own. So much work goes into it, but it is just the beginning. After the property joins the portfolio, it needs to get properly onboarded.

One crucial step of the onboarding process is setting the property’s pricing and minimum stay rules. Spending some time to get this set up correctly will pay off and set the property up for success.

✅ Using the right data

Pricing signals the market and the consumer about your beliefs and expectations for the new property. Setting the pricing too low can signal that the manager is inexperienced in the industry or could cause the consumer to think something is wrong with the property they can’t see in the pictures. On the other hand, setting the price too high could cause the property to become invisible on the OTA’s and be an even bigger problem. Spending some time to get this right up front can have many benefits.

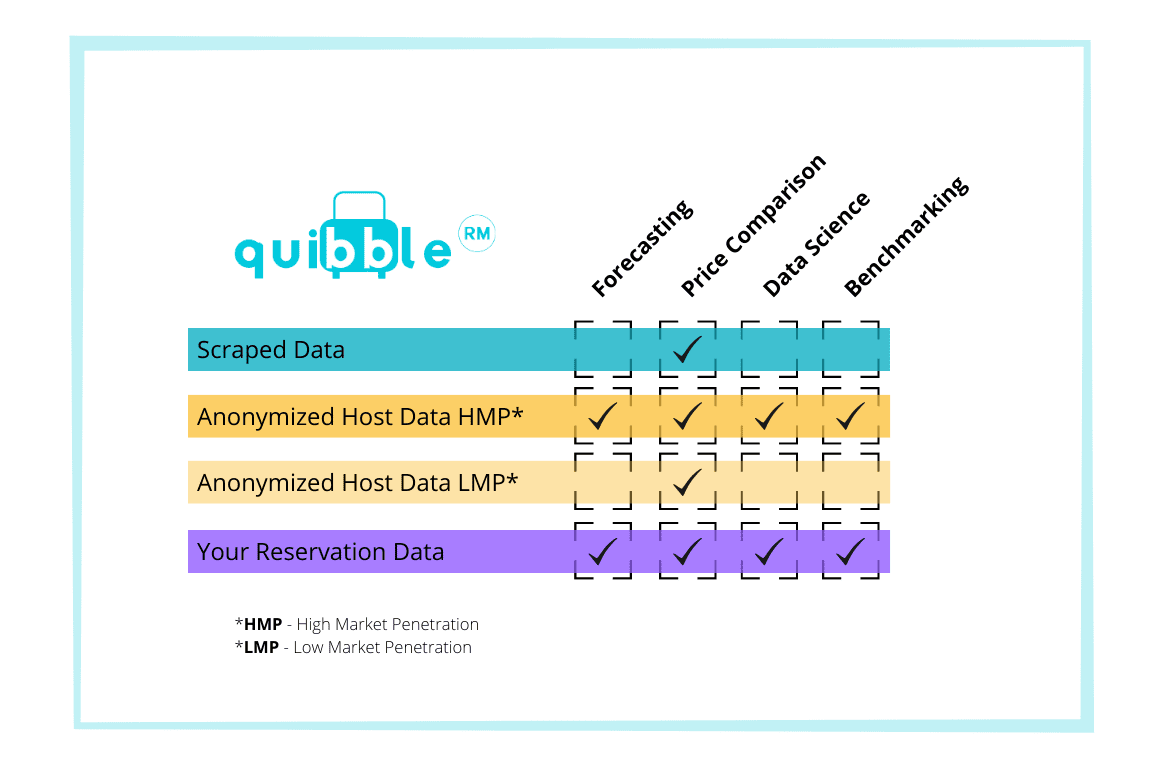

Accurate data is the best foundation for superior pricing. There are two categories of data used in the initial pricing setup: scraped data and host data. Host data has two subcategories: reservation data from your own PMS and anonymized data from nearby competitors. Choosing the right data inputs is critical to setting up your pricing strategy, and often you will need both scrape and host data to inform your strategy.

📊 Data Types

Understanding the difference between these data types is important because they have different qualities, accuracy, availability, and cost. In addition, deciding what data fits your budget and business may change as the size of your business grows and your data needs to change. Below is a description of the different data types and a guide for setting up pricing on your new property.

“But even demand data from abnormal booking periods can tell a story and help you understand your revenue, especially if you are aware of the nuances of the historical data.”

🧩 Scraped Data

Scraped data is the lowest quality data, and if you have enough host data, you should avoid it. What makes this data the most inferior quality and least reliable is its collection. A robot is programmed to visit an OTA like Airbnb or VRBO and collect (scrape) data from its site. The robot will see the calendar like the example below as it iterates through the properties scraping. The assumption made by the scraper is that paying customers books every unavailable day. But as all property managers know, that is not the case. Some of those days get blocked by owner stays. Some days are for repairs, and some get blocked for a cleaning turn. The listing may only be available for half the year when the owner is away in extreme cases. So, this is an unreliable way of determining occupancy or demand.

The secondary issue with scrape data is that the revenue values are estimates, not based on actual reservation data. The scraping robot can check prices for the available days, but then it must make some assumptions about the price for unavailable days. Quibble ran a scraper to test(link to Pricing Benchmarking and Forecasting), and the table below describes what we found. These error levels are big enough to cause a revenue manager to seek a better data source if it is available.

🚀 Host Data – Anonymized

Anonymized Host data is very reliable because the source is the host, which is essentially another property manager’s PMS. The data does not have issues with pricing, occupancy, or revenue. The host knows what a reservation gets sold for; therefore, they see the revenue. They also see the occupancy because they control the inventory availability and know which nights are booked by the owner or blocked for maintenance.

“The host knows what a reservation gets sold for; therefore, they see the revenue. “

The most significant constraint to host data is availability. There are not many vendors offering this data to the STR industry now. Therefore, a middleman is needed to collect and make the data available. The vendor needs to create a relationship with many property managers in a single area to get this data. If a particular area only has 2-3 property managers or very few properties, the anonymized host data will not be very beneficial because the sample size is too small. That also breaks down anonymity. But, once the market has enough participants (customers), the data becomes incredibly useful and reliable. How valuable is this data? That depends on how much market penetration the vendor has in your market. But, in terms of data quality and accuracy, this is the second-best data source you can get.

🗓 Host Data – Your Data

If there is a data source that should be 100% reliable, it is your data. You have direct access to it, and you can verify its accuracy. Best of all, it is free! So why aren’t more managers using their data to manage revenue and set up pricing on new properties? That is primarily due to how reservation data is structured. But this data structure constraint can easily be solved with a revenue analytics platform that uses a revenue proration logic like Quibble Analytics.

“The host knows what a reservation gets sold for; therefore, they see the revenue. “

The most significant constraint to host data is availability. There are not many vendors offering this data to the STR industry now. Therefore, a middleman is needed to collect and make the data available. The vendor needs to create a relationship with many property managers in a single area to get this data. If a particular area only has 2-3 property managers or very few properties, the anonymized host data will not be very beneficial because the sample size is too small. That also breaks down anonymity. But, once the market has enough participants (customers), the data becomes incredibly useful and reliable. How valuable is this data? That depends on how much market penetration the vendor has in your market. But, in terms of data quality and accuracy, this is the second-best data source you can get.

🦾 Ramp-up period

When PMs forecast a property’s earning potential to the owner, they want to paint a rosy picture of big checks and cash flowing in a beautiful stream to their bank account. For a good PM, this is a promise that can normally be delivered. But properties have different levels of maturity. The big OTA’s make money by charging a fee when the property gets booked. Therefore, the OTA wants to encourage bookings and arrange their site, so many bookings occur, and they can collect their commission. They have an algorithm that sorts properties, so the most likely ones to get booked will show at the top. The OTA’s know which properties to put at the top because they already have many bookings. But what happens if your property is brand new and has no bookings? It will likely end up lower on the list and be harder to find for a shopping customer.

Historical bookings are not the only sign to determine if a property performs successfully. Properties with good reviews also perform better and get higher in the search order on the OTA site. People love to know that other people thought the property was worth five stars, and it gives them comfort to book the property.

“People love to know that other people thought the property was worth five stars, and it gives them comfort to book the property.”

That is a bit of the chicken or the egg problem. It is hard to get bookings when your property ranks low and when it has no reviews. However, there is one more lever a revenue manager can pull to help the property climb up the search ranking and start to perform as was promised to the owner, and that is pricing. Pricing also plays into the search algorithm. People are more likely to buy cheaper things, and the OTA wants to show you great deals, so you are more likely to book.

For all these reasons, revenue managers of STRs have had to accommodate for the early period of a new listing’s life with below-market pricing. Unfortunately, the duration of a ramp-up period for a property is not a set formula. It can be as quick as three months or more than nine months. It depends on the size of the property, the quality of the property, the average lead time, and many other factors. Often, the owner is expecting the revenue of a mature property in the first month, but this is very unlikely.

💎 Adjust accordingly

After you get the property through the ramp-up period, the property moves into maturity and becomes more predictable. This property now enters your database and can eventually be used to forecast another property like it in the future. But properties in the more mature phase do not manage themselves. Pricing and revenue management is a continuous process. Every time a booking gets made in your portfolio, your neighborhood or city is a chance to learn something and then tweak something to squeeze out just a little more.

Join our newsletter

Dominate the short-term rental market with cutting-edge trends