📌 Revenue Processing

Before looking at revenue forecasts, trends, and year-over-year positions, it is critical to understand how to read STR revenue numbers and how they come about. Technology providers collect a lot of the same information when they create a reservation, but all providers do not yet adopt an industry-standard list. As a result, some datasets need supplements and enhancements to provide a complete view. In addition, when the data gets stored, detailed pricing information is not attached to the reservation and is often lost. This highly relevant and valuable data can be unrecoverable in most scenarios.

“When the data gets stored, detailed pricing information is not attached to the reservation and is often lost.”

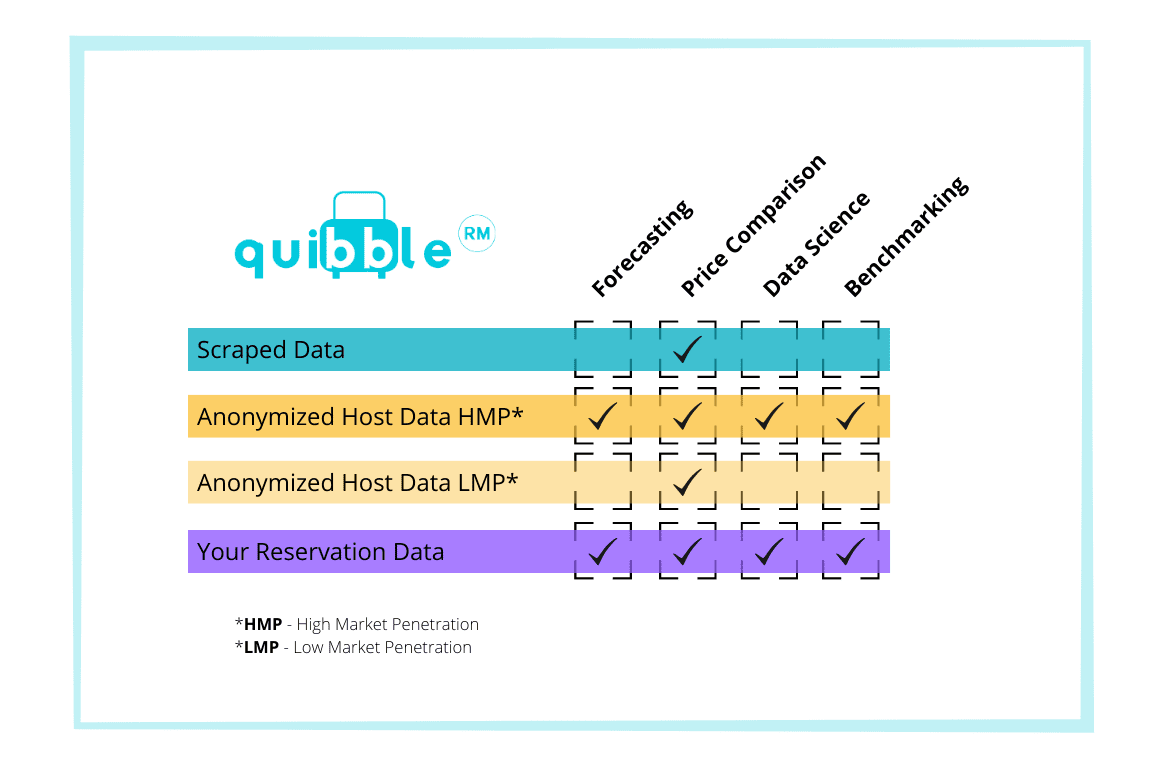

Reservation data is not suitable for revenue management and pricing purposes in its raw form. Its design purpose is to be used by a reservation system or revenue accounting. The reservation data needs to be processed and transformed using several methods to prepare the information for analytics and forecasting. Quibble sorts the revenue data, prorates the reservation, and uses Real-Time Price Capture to collect the accurate pricing data. These processes allow for refined analysis and forecasting of future outcomes using reservation data.

🛠 Revenue Sorting

Quibble sorts revenue into three buckets: Rent, Ancillary, and Tax. These buckets account for the relevant metrics we care about and can manage. For example, changes in rental rates and ancillary rates directly impact the booking decision. For that reason, we separate them to isolate the effect of their change over time. Nine out of ten times taxes are not very exciting, but they still get their bucket to ensure accuracy.

The overwhelming majority of analysis gets done on the Rental Revenue data. That is primarily because the rent makes up the bulk of the revenue and informs our nightly rates. Adjusting the future nightly rates as reservation data streams allows property managers to increase their revenue. They can also evaluate the impact of changes to the pricing strategies. For example, when managers increase prices, they anticipate increasing their total revenue. But the market does not always respond as managers expect, and if the booking pace decreases due to the increased pricing, it will be visible in the reservation data.

Ancillary includes any additional revenue that is not rent and not tax revenue. The majority of this revenue comprises cleaning fees, but other fees and ancillary revenue are notable. Cleaning fees and additional charges like insurance are not adjusted nearly as much as the rental rates. Rental rates can change once or several times per day for a property.

It is less common for ancillary revenue prices to adjust as frequently as nightly prices. They usually are part of a larger strategy and reflect the actual cost to the manager of cleaning a rental property or insuring it against damages. But these fees do end up in the total cost to the consumer, and they impact the booking decision. The consumer expects these fees to be reasonable and commensurate with the rental rate.

“The consumer expects these fees to be reasonable and commensurate with the rental rate.”

Ancillary fees should increase as the expense of servicing them increases, but they can discourage bookings if they get too high. This type of fee analysis is more of a long-term strategy since these fees change at a slower rate than rental rates. The ancillary revenue trends can help determine the best pricing strategy for your ancillary products.

⚙️ Revenue Proration Process

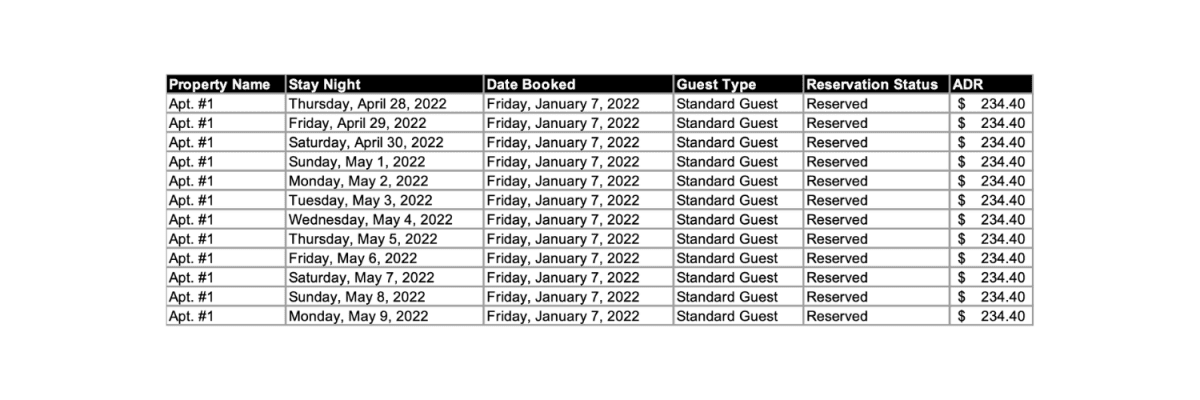

Data storage of Guest reservation information most commonly looks something like this:

Reservation data is stored in this structure and reported on from this structure. This single line of information is missing relevant attributes of the reservation and causes analytics to be incorrect. For example, the revenue is not attributed to individual calendar days since it is in a single line, which causes issues when reporting on revenue earned by the month. It also does not allow us to analyze which day of the week was reserved and for what price. This data provides reporting consistent with GAAP standards but not for pricing and revenue management.

For that reason, Quibble has designed a revenue proration process to correct and enhance every reservation as it enters our database. The prorated form of the reservation looks like this:

The above example is the same reservation transformed and stored in a new structure. The prorated design allows for the revenue to be property attributed to the booking dates at the correct level.

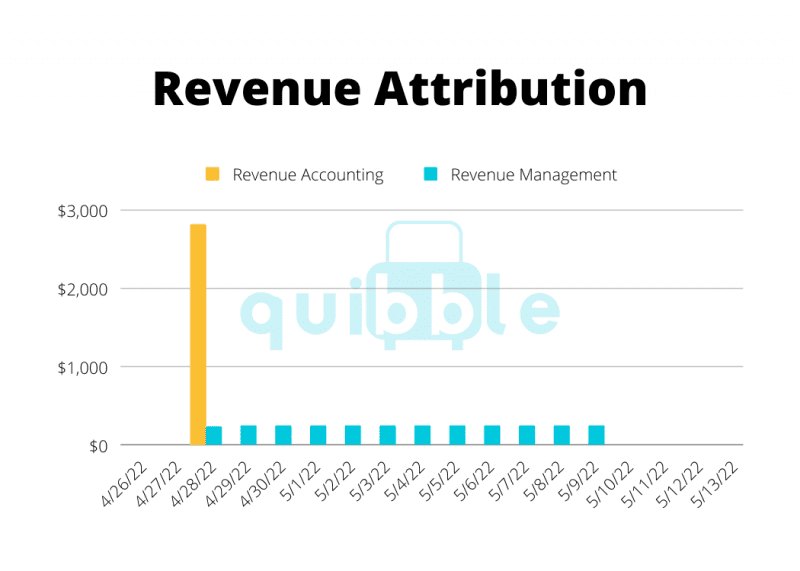

Revenue reporting in PMS and other RMS attributes revenue to the first day of the reservation, like the example below. This reporting is consistent with GAAP revenue accounting standards. According to GAAP, a reservation’s revenue gets recognized on the first day of the reservation with accrual-based accounting.

Revenue Managers look at data differently than Revenue Accountants. We are more interested in how much revenue gets booked for each calendar day. The reservation example above spans two months, from April to May. A revenue manager wants to know exactly how much revenue sits in April and how much sits in May.

“A revenue manager wants to know exactly how much revenue sits in April and how much sits in May.”

This matter also impacts the occupancy rate of each month. The Revenue Accountants’ use of the data is different, as they want to know when it is appropriate to recognize revenue. For that reason, the reservation data has to get transformed using the revenue proration process for use in revenue management.

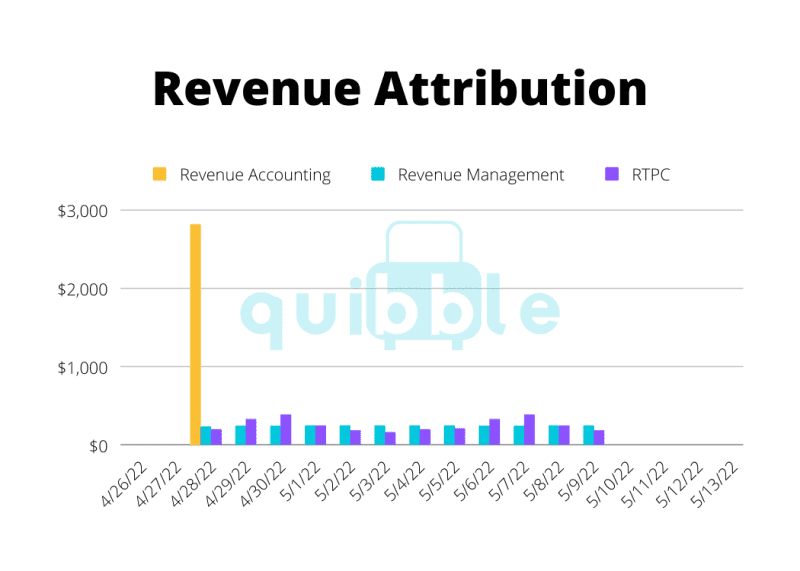

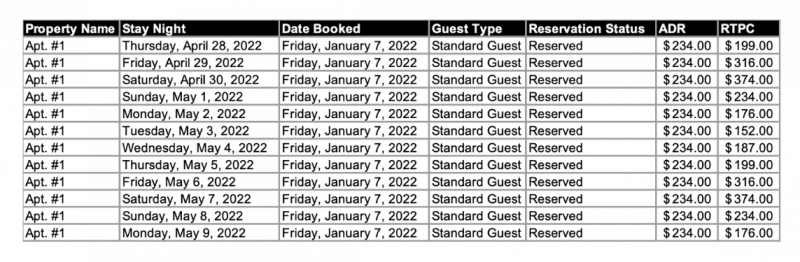

🎯 Real-Time Pricing Capture

Quibble’s revenue proration process cleans up the data and structures it properly for revenue management and pricing. But there is still data missing from the reservation. For example, when a reservation gets created, the unique price points set for each day in the reservation are not captured. This is because the reservation system (PMS) is not designed to capture this data inside the reservation. But the vital matter is that this data is relevant for forecasting systems like Quibble RM, which uses historical reservation data to optimize future prices. For that reason, Quibble has designed Real-Time Pricing Capture (RTPC). RTPC captures the unique pricing data at the calendar day level and attaches it to the prorated reservation.

From this captured data, it is possible to see that Friday and Saturday rent at substantially higher rates than Monday and Tuesday. That may seem obvious, but the change between the lower and higher rates is critical to the revenue optimization process. Before RTPC, this data would have been lost forever (if not made extremely difficult to extract) since the reservation itself does not store this data.

“Before RTPC, this data would have been lost forever (if not made extremely difficult to extract) since the reservation itself does not store this data.”

💡 Conclusion

STR revenue can tell the story of your property management company and its performance. It can tell you what to do about your pricing and allow you to forecast your future revenue accurately. Before that story can be told and understood, the revenue has to be understood at the reservation level.

“Before that story can be told and understood, the revenue has to be understood at the reservation level.”

It needs to get processed in a new way for revenue management analytics. Quibble has designed, automated, and implemented these processes for its users. These are the data that feeds into the Quibble Analytics platform.

Join our newsletter

Dominate the short-term rental market with cutting-edge trends