Revenue managers have a finite amount of daily time to make decisions. Each decision they make should improve the probability of increased revenue, and they must spend that time efficiently to have the most significant possible impact on revenue performance. A single property in a portfolio will have availability 365 days into the future. For large portfolio managers with hundreds or thousands of properties, this is a vast number of price points to manage. It is simply impossible to review all the prices set for every available night for every property every day.

This necessitates the revenue manager making decisions about which properties and periods to prioritize, and there are better and worse ways to do so. The better way is to sort by the most significant revenue opportunity, which can be counterintuitive to an inexperienced revenue manager. It may seem obvious that the property with the lowest occupancy has the biggest opportunity, but that is often not the case. Revenue managers now have more sophisticated metrics to increase their daily efficiency.

✅ Manage what is empty

A simple way to find revenue opportunities is to look forward and find the properties with the fewest bookings or lowest occupancy. This method allows the manager to react to low-demand periods in the immediate future. It is a safe strategy because it biases towards not leaving any properties empty. The strategy fails because it does not consider a demand forecast before adjusting the price.

The remaining forecasted demand will be different for each property depending on the days left to book and the property’s specific attributes. Low-booked properties in the city center have a different booking profile when compared to those in ski destinations. City center locations may just be entering the peak of the demand curve when the ski property may have no demand left at all. Spending time adjusting pricing on the ski property with only a week left to book may be a meager revenue opportunity because the probability of a reservation arriving in this window is so incredibly low.

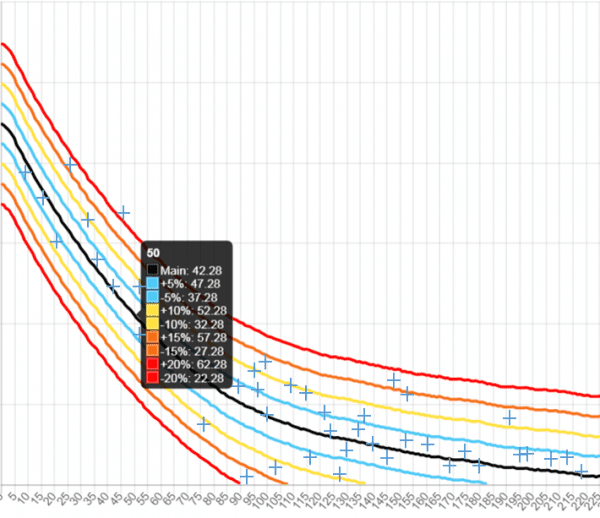

📊 Use a forecast curve

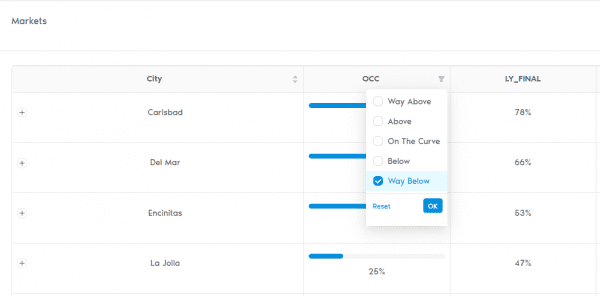

Forecasting is the process of guessing what will happen in the future, and a forecast curve is an aid to assist managers in building a forecast. A good forecast curve allows the managers to see the critical times for each season, city, neighborhood, building, and property. Even more importantly, it will enable them to properly prioritize which properties are in the normal forecast range and which ones are not. The timing of the pricing adjustments is critical. The sooner a manager can find the properties diverging from the curve, the quicker they can adjust. Properties can also outperform the curve, which requires a price increase before the inventory sells too cheaply.

“The timing of the pricing adjustments is critical. The sooner a manager can find the properties diverging from the curve, the quicker they can adjust.”

Using the appropriate forecast curve allows the manager to see which properties are performing well and which are not. Since they are being benchmarked to a continuous curve, the metrics update every time a reservation is made. At any point in time, there will be listings way above and below the forecasted position. The further the property deviates from the forecast, the more likely it needs to be addressed from a pricing perspective.

Forecast curves are created on a seasonal and regional basis. After they are assigned to each property, they can start being used to categorize the property’s behavior and flag it for potential review. Those properties way below the curve have a much higher priority than those that behave right on the curve. The primary benefit of managing outlier behavior this way is that the method considers each property’s seasonality and booking trend in real-time.

🚀 Revenue Opportunity Model (ROM)

The above methods are forms of demand management that use booking trends to direct managers where to spend their time making price adjustments. They can help managers use booking data to find opportunities quickly; these methods look primarily at demand, not revenue. A good revenue manager is not an occupancy maximizer; they are a revenue maximizer. The question a revenue manager needs to ask themselves at the beginning of each day is this: with the limited time I have today to review and adjust pricing, where can I make an enormous revenue impact? The answer to that question lies in the ROM.

“A good revenue manager is not an occupancy maximizer; they are a revenue maximizer.”

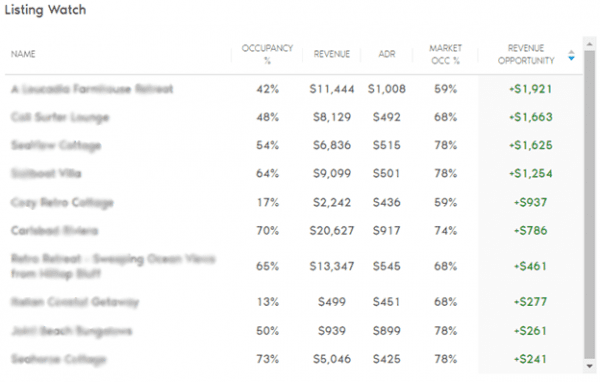

ROM begins by estimating a given property’s earning potential by considering its current performance and the current performance of its peers. Then the model estimates the opportunity, or, said differently, how much more revenue this property could produce. This is a far more powerful metric than determining whether a property will be full or empty in the future for a given time. It is a roadmap for the analyst that lets them know how much revenue is available and where the biggest opportunities are to capture the additional revenue. ROM prioritizes revenue, not occupancy, which is precisely what a revenue manager should do.

“ROM prioritizes revenue, not occupancy, which is precisely what a revenue manager should do.”

This metric is calculated at the property/month level; in this view, it shows the analyst which properties have the biggest opportunity by month. For large portfolio managers, ROM can be calculated by city or state too, and sorting the property list by the revenue opportunity clarifies where the analyst should spend time. Not only will the analyst make the best use of their time, but how much revenue they can generate if the issues with the high-opportunity properties are corrected.

There is also a strong feedback loop built into the process. Every day, a certain amount of revenue is at risk, and the model calculates that. Tracking ROM allows the manager to see on a day-over-day basis how much of the at-risk revenue they could capture.

💎 Conclusion

It is essential for a revenue manager to start each day with a strategy on how they plan to attack their properties. There are good, better, and best ways of setting that strategy. At Quibble, we are committed to helping managers improve their strategies every day. ROM is a positive metric to add to your revenue management toolkit and is included in the free version of Quibble analytics. If you have questions or want a consultation on your revenue management practices, contact me at [email protected].

To help you get the best possible guide, schedule a demo here.

Join our newsletter

Dominate the short-term rental market with cutting-edge trends