“Turnover is vanity, profit is sanity, but cash is king for your business.”

👑 Cash is King

That is a widely used quote highlighting the most crucial metric in any business. Short term and vacation rentals can provide excellent cash flow opportunities, and this is a beautiful quality for both owners and investors. These opportunities only shine when the properties are managed effectively and priced correctly.

Very often, we see vacation rental managers focusing on either occupancy or average daily rates. Both metrics are important and useful. However, we need to use them in perspective, not in isolation, to determine how effective your pricing strategy is and how efficient your property is performing.

💵 How do we measure cash?

The hospitality industry measures cash or rental income by the Revenue Per Available Room or RevPAR. RevPAR is the most-widely used metric in our industry; it is the easiest way to quickly understand property performance. There are several ways to calculate RevPAR. The most straightforward way to calculate it is by dividing your total revenue by the total nights available. Do not get confused with the number of days occupied, as you will be calculating your average daily rate instead. You can also calculate RevPAR by multiplying your occupancy and average daily rate. Below is an illustration of the building blocks of RevPAR and how to calculate each metric.

To calculate RevPAR, you must accurately obtain the underlying metrics. Many times we see vacation rental managers utilizing the wrong supply or revenue figures. For supply or total nights available, you will need to remove all maintenance and owner blocks. In both instances, the property was not available for such nights. Therefore, it was never available for booking and is not part of your supply. To calculate an accurate RevPAR, you need to use your actual room revenue. This revenue figure excludes all taxes, cleaning, linen, and resort fees.

✅ RevPAR is the starting point

Thus far, the standard approach to short-term and vacation rental revenue management has been attempting to guess a daily rate given that day’s market average daily rates. But what if the daily rate guess does not align with your expected RevPAR? That is why demand forecasting becomes the most critical aspect of revenue management. You need to understand where you are going (or at least have an idea) before you start moving. After all, you wouldn’t start your drive without a destination.

Quibble’s foundation is on forecasting the RevPAR ranges your property should achieve given historical data, booking patterns, seasonality, and unique real-time market influences. Knowing your RevPAR range will help you optimize your occupancy and average daily rate most effectively and accurately possible. That will help you achieve the highest RevPAR outcome for each property. As properties tend to be unique in many different ways, managing towards RevPAR helps keep the focus on what’s important, especially during extraordinary events such as Covid-19.

RevPAR forecasting is the combination of 1000+ data points and unique property attributes. It is vital to effectively interpret changes in guest counts, property amenities, length-of-stay, and market inventory to forecast your maximum rate per available night accurately.

What our Revenue Managers at Quibble do for our clients is make these tough decisions. We use data and market intelligence to decide how many Seasons a property needs, what the demand pattern is for each day of the week, and when to update the Seasonality to capture new trends. We are continually reviewing local and global trends to make these decisions.

⚙️ How is RevPAR impacted?

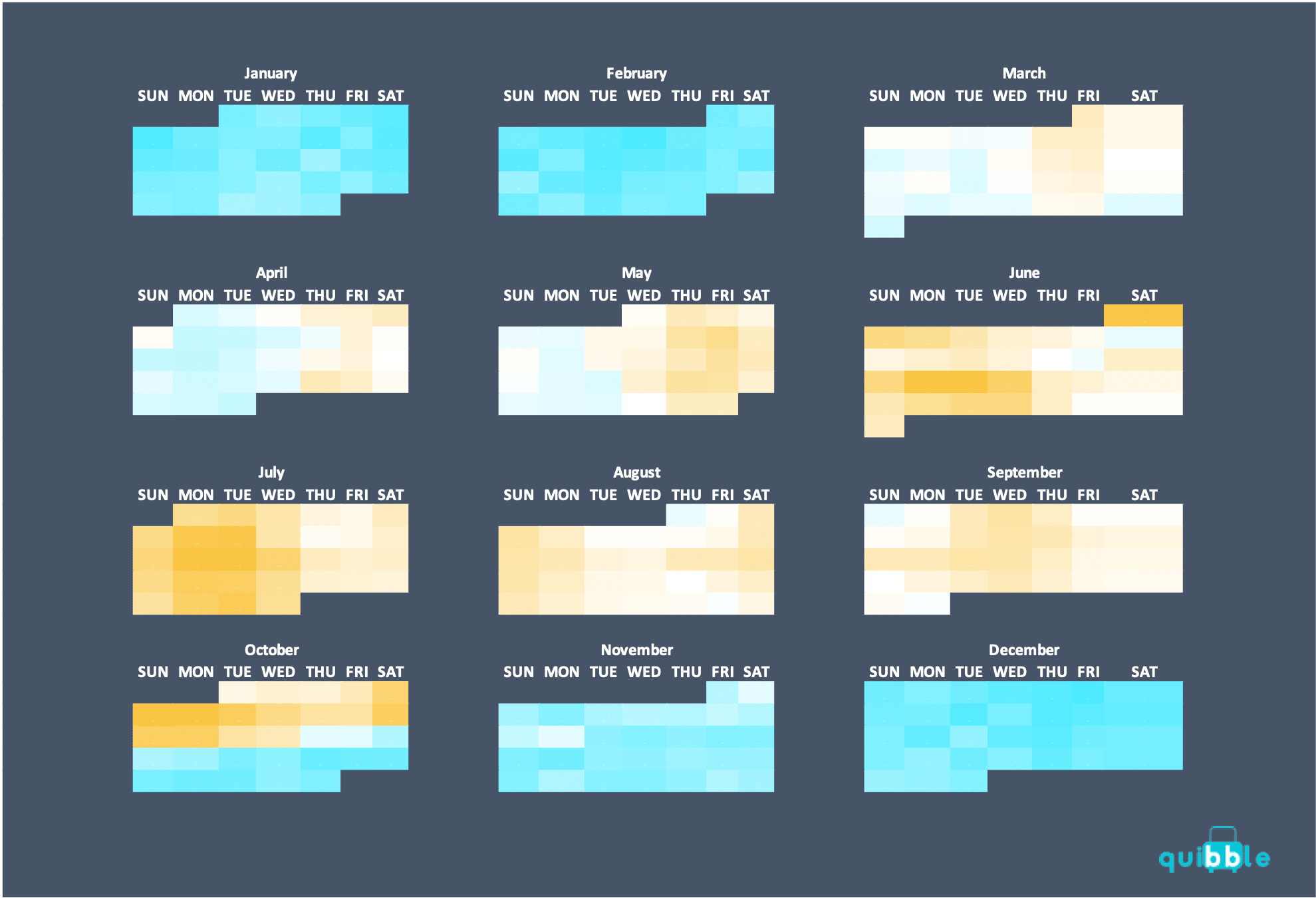

It is essential to understand what impacts RevPAR. Many factors can positively and negatively impact RevPAR performance. Some elements are controllable, while others not so much. All travel and hospitality business markets have high, shoulder, and low periods or seasonal components. RevPAR will have the same variability. Understanding seasonality and applying it to your RevPAR forecasting exercise will help you derive the most optimal occupancy and average daily rate strategy. It will enable you to know which days or months you will need to focus on your occupancy and daily booked night pace versus your average daily rates. Take, for example, the city of Chicago. Chicago has one of the lowest winter RevPAR performances in the United States. Understandably not many people visit Chicago during such cold and frigid weather. RevPAR will be affected by decreased demand, which puts pressure on daily rates. Because your occupancy rate will be RevPAR driven, you will need to establish your rate strategy much in advance to increase the amount of time the property is available with its most optimal seasonal price.

⚖️ The Balancing Act

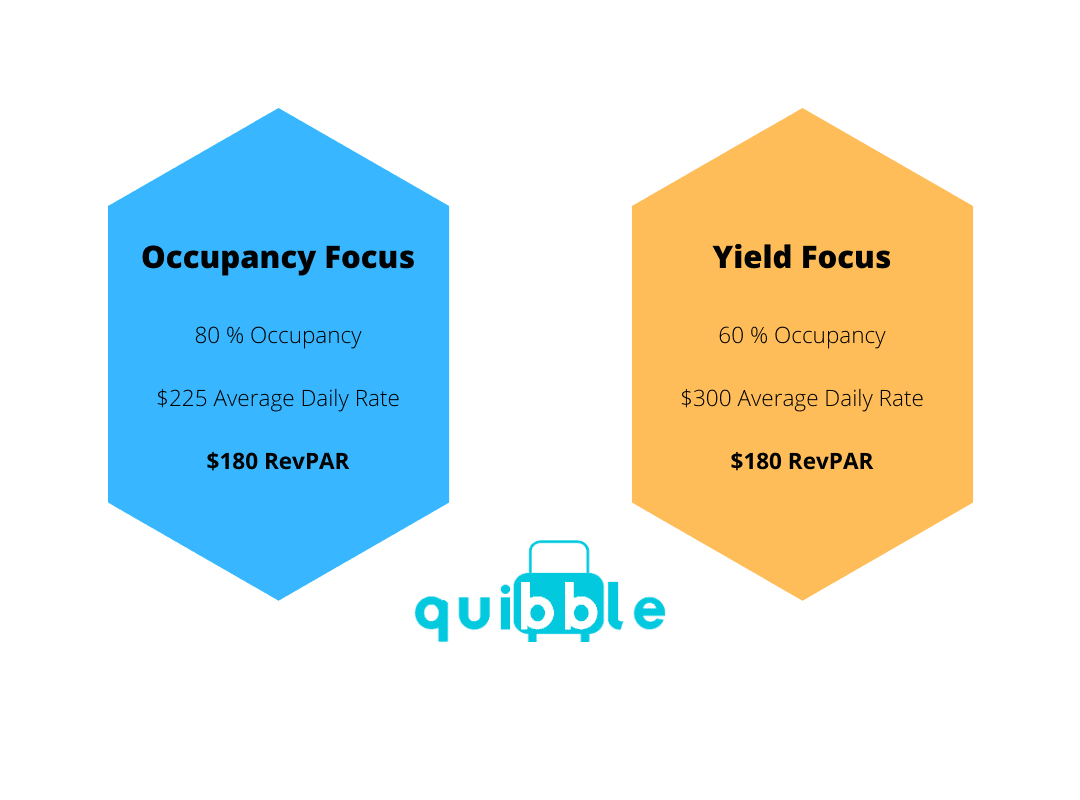

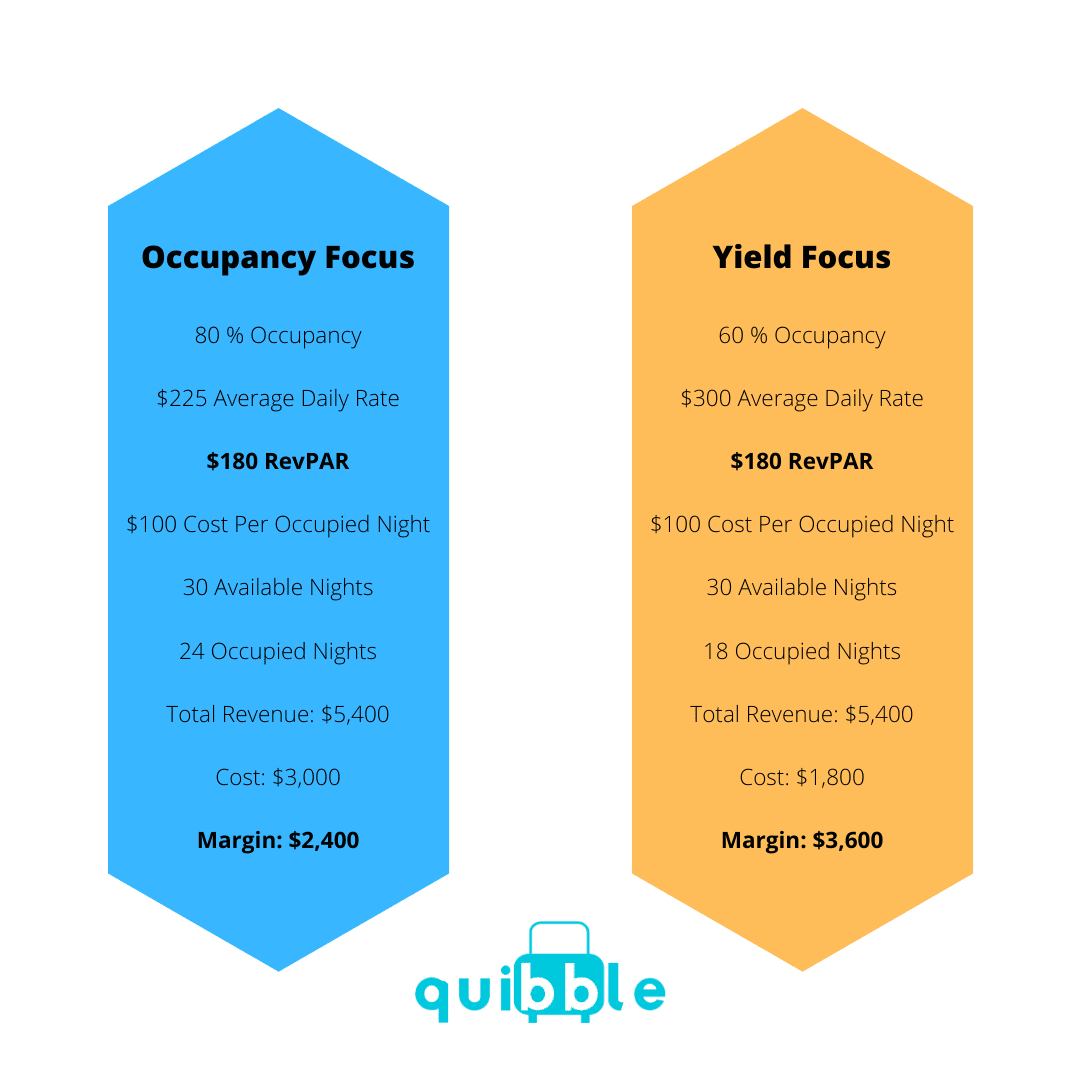

We see how often revenue managers gravitate towards one specific strategy. More aggressive strategies will concentrate on higher occupancy rates and lower average daily rates. In contrast, others might pursue a higher rate in exchange for less occupancy. In reality, it is a delicate balancing act that will get you to the most optimal RevPAR result. Shown below is a clear example of how each revenue management strategy can lead to the same RevPAR.

We have seen the difference in the impact of these strategies on the bottom line margin. Short term and vacation rentals have a different set of variable costs versus airlines, for example. In the hospitality industry, the higher your occupancy rate, the higher your variable expenses will be. Every night you book your property, you will also increase RevPAR. However, if you do not know your break-even RevPAR, you won’t have a direction moving towards your goal.

That is why choosing the right balance between occupancy and the average daily rate and continuously optimizing both metrics is paramount to achieve maximum RevPAR, thus improving your bottom line.

Running a high occupancy rate is not always the best strategy. Because variable costs positively correlate with occupancy, it is essential to maximize revenue through yield optimization during compression dates. You may shift to an occupancy strategy for less compressed dates knowing your cost per occupied night and applying your minimum seasonal rate. It will help set up a seasonal profile and expected occupancy. Let’s expand our previous occupancy and yield focused strategies. Below you will see how RevPAR affects your bottom line drastically.

It is common to find vacation rental managers, revenue management professionals, and pricing software relying on a high occupancy rate as a means to drive revenue. That is because a high occupancy rate is much easier to achieve than a high average daily rate in most cases. The gradual pushing down of prices is referred to as the spiral down effect of revenue management. It is one of the biggest problems in the field of Pricing and Revenue Management and has been that way for years. Accurate and frequent forecasting is the best cure for the problem.

🎯 How to Maximize RevPAR

Quibble continuously adjusts for demand fluctuations and price elasticity for a given RevPAR threshold for every single bookable night of the year. In other words, we balance the RevPAR prediction individually given each available night’s forecast. Understanding RevPAR contributions will vary by day of the week, and it will make it easier to price out differences between high demand days and their counterparts. Day of week RevPAR contribution is critical to your property’s continued success. For example, a 3-bedroom home will have a higher day of week variance versus a 2-bedroom apartment. This variance results from higher price elasticity because of guest count during weekends, Thursdays through Sundays, is 2-3x higher versus weekdays, Monday through Wednesday. Through daily rate maximization, you can reach your RevPAR goals for most weekends since the industry tends to have a higher demand. For smaller properties, RevPAR will have less rate variability, and occupancy takes the driver’s seat. Smaller properties, those with 2-bedrooms or less, are prone to see consistent demand even during distressing times.

A perfect example is the city of Nashville. During May through October, short-term rental properties with 2-bedrooms or less have experienced 31% higher occupancy versus 3+bedrooms properties. Systems and revenue managers both need a solid understanding of Seasonality and Day Of Week patterns to maximize RevPAR.

👋 Keep it simple

The short-term and vacation rental business is complicated. Many variables come into play simultaneously. It is a challenging job to balance all of them as quickly and effectively as possible. However, it is impossible to do so if you have the right team and adequate analytical tools to decipher the optimal RevPAR effectively.

RevPAR is our north star, and it should be yours too. There is beauty in keeping things simple. Our fascination with predicting the maximum revenue your property can produce is what keeps us engaged and our computers running. Do not chase the highest occupancy. Do not run after the highest average daily rate. Take the time to understand each RevPAR scenario’s probability or let our computers do it for you. It will help refine your revenue management strategy, set appropriate goals and revenue expectations for your homeowners.

Join our newsletter

Dominate the short-term rental market with cutting-edge trends